It’s the marketer’s age old dilemma to determine: “Is my campaign working? Which ad is performing best?” Traditional TV buyers are used to getting questions like these from their clients and rarely do they have a straight answer. Some will cite the final C3 rating of a show they advertised in (from three weeks ago), or the relative CPMs that they pay for each property (which has nothing to do with performance). Or they might examine how a deal is tracking against its audience guarantee (on age/sex demo, of course). When the digital team is asked those same questions in regard to their digital campaigns, they’re armed and ready with powerful data answering exactly these questions with compelling stats that illustrate specific performance like sales or foot traffic. In a world of marketing where data rules, it’s no wonder traditional TV rarely gets the credit it’s due (because there’s been no data to back it up). That is changing as the worlds of TV and Digital converge and addressable, increasingly trackable platforms like Advanced TV continue to grow.

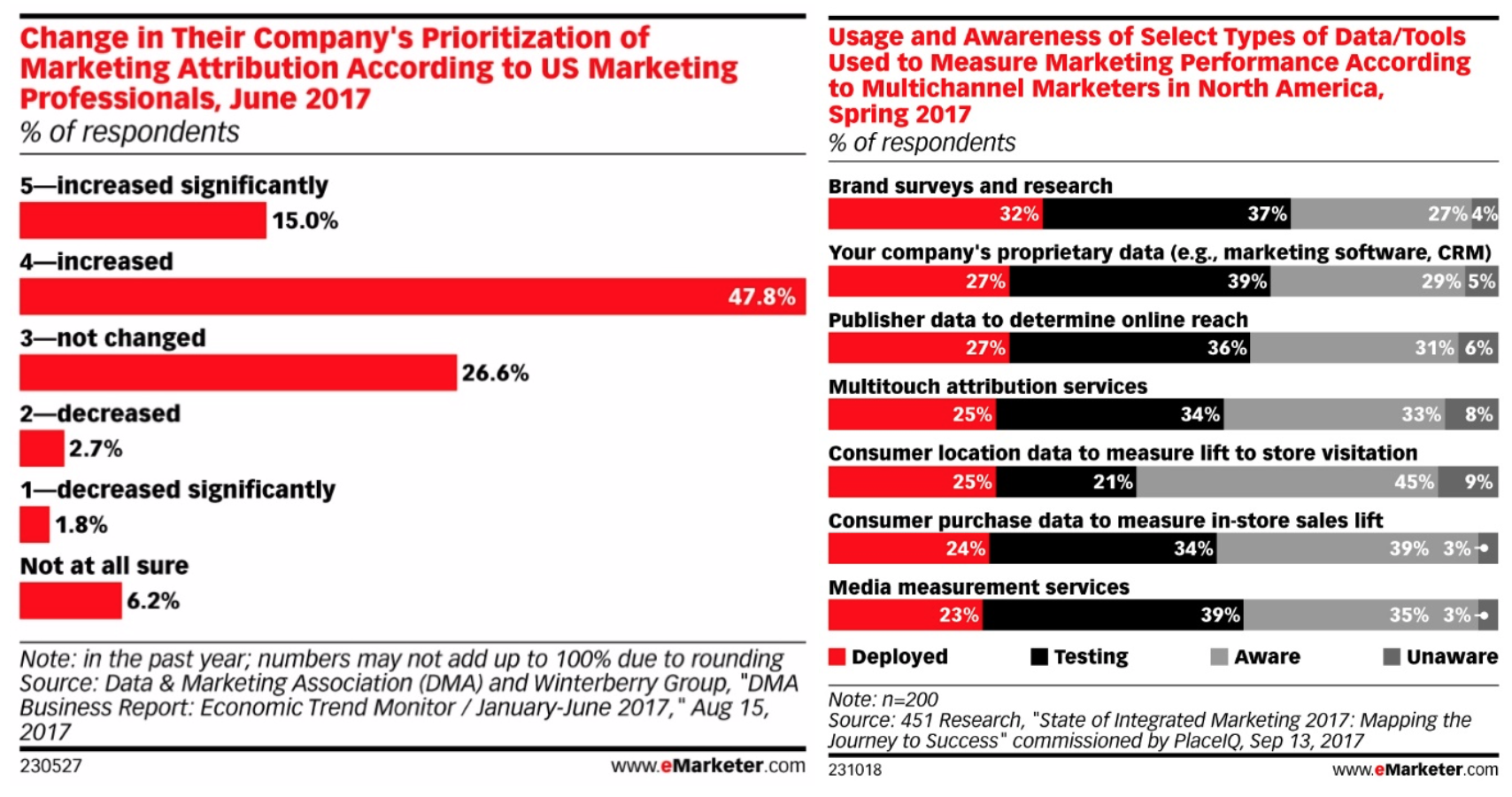

As the media landscape becomes more complex and fragmented, so too does the importance of proving attribution amongst the various channels and platforms. Each has its own intricacies when it comes to how it’s measured, which makes unifying campaign measurement a near impossibility. Outcome based analysis can help level the playing field. After all, who cares how many impressions were delivered on one platform versus the other when what matters most to a brand is the outcomes that it drove? Marketers—regardless of whether they’re an incumbent or start-up—want to know most of all: “How many conversions did my digital campaign drive versus my Addressable TV or OTT campaign” and “How much did it cost to do so?” Through this lens, marketers can begin to compare on an apples to apples basis.Marketers are discovering the power of “proving it”. Indeed almost two-thirds of companies (62.8%) see attribution as an increased priority for their company. Furthermore, they are taking advantage of the wide-range of data and measurement services now available to them. Whether it’s from a traditional survey that measures brand health metrics, via third-party transactional data, their own first-party CRM data, or through partnering with location data services, the vast majority of multi-channel marketers (90%+) are familiar with these services and about a quarter of them are actually deploying them.

|

And now (finally) TV is getting into the mix. The advent of Advanced TV products such as Addressable TV and OTT/CTV are bringing digital-like reporting capabilities to the big screen (check out our OTT Overview). By leveraging these platforms, advertisers can now target beyond traditional age/sex demographics and have their ads served to only those households that fit their specific targeting qualifications (as detailed in our Advanced TV Targeting Primer). Attribution can finally be measured more accurately on the big screen since the exposed audience is now understood more granularly than ever before. Knowing who saw an ad and completed some sort of brand action (visiting their store or purchasing their product online, for example) are the two basic components needed for attribution studies. But how does this all work?

Our new guide—the Advanced TV Attribution Buyer’s Guide, which was developed in collaboration with the IAB’s Advanced TV Attribution Working Group—is designed to provide buyers, as well as the rest of the ecosystem, with an overall understanding of what attribution is, how it works across Advanced TV, and the best practices that can be leveraged to ensure a smooth process from beginning to end. While these may not be easy concepts to understand at the outset, after reading the guide, our hope is that you will become more willing to test and learn which will lead to more effective planning, measurement, and confidence in “proving it” along with your inventory and attribution partners.

To illustrate further the opportunities and challenges in the practice of Advanced TV attribution, below are highlights from our discussions with Mike Welch, SVP Corporate Strategy and Business Development from Xandr and Michael Law, EVP, Managing Director of US Media Investment from Amplifi-Dentsu Aegis Network

View the Advanced TV Attribution Buyer’s Guide

Q&A with Mike Welch, Xandr

What are the common misconceptions brands and agencies have regarding attribution in addressable TV?

Clients need a better perspective on results – good and bad. History has shown that addressable works, so brands should view disappointing results as an opportunity to improve on targeting, creative, frequency, etc. The same applies to positive results – the focus should be on learning from and building upon the results to make future campaigns better and more efficient. There also needs to be a greater understanding of the dynamics between brand objectives, targeting and attribution. A conquesting campaign is unlikely to produce the same lift as a campaign targeted to current customers, although both types of campaigns represent significant value for brands. Conquesting sets a higher bar for marketers, but there is also enormous long-term value in maintaining consumer relationships.

|

What percent of Addressable TV deals that your team sees include some sort of attribution study?

Over 90% include them. Not having an attribution study is now the exception, not the rule. There are certain advertisers who have seen consistent attribution results and so opt to run without a study.

Can you share an example or two of a brand using the results of their studies in a new or interesting way?

Direct mail advertising has been particularly applicable as the foundation for addressable TV advertising, since often [name and address] inputs can be used for both formats. This allows us to understand how the two work together. For example, we are able to measure acquisition rates if you run addressable TV ads prior to or concurrently with a mail drop. We can also measure whether addressable TV advertising can be an effective replacement for direct mail. In terms of understanding campaign reach: As addressable matures, more advertisers are looking at how addressable and linear television complement each other. Addressable has been proven to distribute frequency more evenly via frequency caps, a major hole in traditional TV. This leads to higher reach given our ability to reach light TV viewers and cap heavy viewers. I think a focus of the future will be more about the technology of addressable, which will lead to widespread adoption.

Who is driving the spending in Addressable Linear/VOD? Is it the TV or the Digital teams and do you think that they understand the attribution process?

We are predominantly still working with TV teams, but many agencies have created Advanced TV teams to specifically focus on this growing medium. We’re also seeing teams and strategies start to merge at a high level. For example, we have several upfront partners who look at addressable as simply part of their “video” budget. This is likely the way of the future, with video overall converging and the silos of TV and digital collapsing. It will be important for agencies to evolve in this way to keep up with technology and client demand.

What do you feel will be the next big leap forward in Advanced TV attribution? Better technology? More standardization?

Increasing investment in attribution will lead to better technology, faster turnaround times, and more hooks into more data sets, which we are working on today.

Q&A with Michael Law, Amplifi-Dentsu Aegis Network

How is your agency structured when it comes to Advanced TV investments?

We try to think of video across all screens as holistically as possible. Within Dentsu Aegis Network, I sit within a group called Amplifi, which is our centralized investment team. For OTT and Addressable, we have a ‘center of excellence’ that sits within Amplifi and is considered a non-linear video team. It’s a handful of people who are really focused on Advanced TV and understanding who the partners are while helping the buying teams negotiate deals and size their target audiences. The vast majority of these investments are activated and maintained by the video investment team. There could be some places where connected TV would fall under a digital buying team based on some of the targeting capabilities, but in those instances it would be more of a collaboration between both teams. The role of the center of excellence is more to have structure and best practices in place. They are consulting both the day-to-day agency teams and directly with our clients about changes in the landscape and how Advanced TV can most effectively be used in their overall media mix.

Can you explain further the role of this center of excellence team in how they operate within your agency? Are they going around actively promoting Advanced TV or are they called on to help when necessary?

It’s a little bit of both. We are actively promoting the use of Advanced TV into media planning. That’s the front half of the job. We are really trying to educate the planning, buying, and client communities around the importance of the space, how it works, and how it can be leveraged. Once the planning teams say ‘yes we want to do this’, they are then going to work with their day-to-day investment teams supported by the center of excellence. So for example, the first time you try to size an audience with Xandr, if you did that with no knowledge of the questions to ask, you’d be running blind. But with the COE in place, they can help them get up and running while also providing best practices along the way. They’re really pushing it from an educational standpoint (the ‘why’ we should be doing it) and then they’re continuing to help with the ‘what’ and the ‘how’ in the middle and on the backend.

How has your agency handled learning and development when it comes to teaching traditional linear or digital buyers how to navigate Advanced TV?

I don’t think there’s one straight answer because there’s so much education that needs to happen. We try to bubble up the biggest topics and then provide a very broad overview. For example, we held a Connected TV Day, which included four partners who came in and gave presentations specifically about their platform. It was everything from a partner who was selling the media to a partner who was measuring the media, so it gives you kind of a holistic point of view and even what kind of content lives on those platforms. Since there are so many partners in this space, the COE is the first point of entry for many vendors. We try to filter that information so that we can make it as impactful and relevant as possible to the investment teams. It’s a constant learning and application experience because as we all know, it’s a complex landscape.

|

In your opinion, who is having a harder time in understanding this new space? Is it the more junior level buyers who don’t have preconceived notions of how TV or digital works or the more seasoned employees who are either TV or Digital experts and now have to learn a whole new skillset?

I think everybody in their own right is struggling to understand this space. At the most basic level, there is terminology that needs to be understood by everybody. I think everyone has their own definitions. Every client thinks about it differently, too. If anything, maybe some of the junior people are understanding it better because they are natives—this is how they live their lives so they understand that content is available everywhere, where some of the more senior people may be more unfamiliar and less digitally-savvy. I think at each level there are struggles to really understand the space in the best way. We’re also seeing two groups of people starting to form: there are those that have dedicated the last couple of years to really understanding the space and then there’s a group of people who don’t know much about it. We are working hard to bridge the knowledge gap.

With regards to attribution, do you find that your clients are pushing your teams to run these studies? Or is it the other way around?

It’s a little bit of both, but I think the clients are currently pushing it a little bit harder under the premise of “we want to know how every dollar is working for us”. Every single new business pitch now addresses how we are going to measure success. This is a space where there are so many potential answers—how you create consistency is definitely a challenge. It’s a very crowded space and like anything, often times if you search hard enough you can get the answer you want. But what is the best way to create some sort of attribution product or some sort of measurement that helps you understand your business? There is a disconnect today between business results and what’s considered success. What I mean by that is a cheap CPM does not mean better business results and I think that the industry is faced with a challenge of how to balance those two things. Legacy measurement systems can be benchmarked but it’s flawed since the audience is becoming so fragmented and not measured accurately. What if I could show you better business results but it means that your CPM would be higher? That balance is a fundamental challenge in our business.

What do you feel will be the next big leap forward in Advanced TV attribution? Better technology? More standardization?

I think it has something to do more with the standardization side – how do you more consistently define success? I go back to what I said in the previous question—the next big leap forward in ATV attribution is alignment on what defines success. And while standardization is important, at the same time so is customization. Measuring CPG product sales versus car sales are two totally different things. I think that the momentum of this industry is what holds us a little bit from that. Agencies, clients and partners all need to work better together.

View the Advanced TV Attribution Buyer’s Guide