Digital Advertising Continues Increased Revenue Trajectory

NEW YORK, NY (November 13, 2018) – U.S. digital advertising revenues for the first six months of 2018 soared to $49.5 billion—the most advertisers have ever spent on digital media in a first half of a year—according to the latest IAB Internet Advertising Revenue Report released by the Interactive Advertising Bureau (IAB) and produced by PwC US. This represents a dramatic 23 percent year-over-year increase from the $40.3 billion reported for the same period in 2017.

Report analysis attributes the growth, in part, to the rise of the direct brand economy and the related increase in mCommerce. No longer satisfied shopping solely in brick and mortar stores, consumers are embracing new digital-first, direct-to-consumer (DTC) brands or product lines that often do not appear in-store at all, driving advertisers and retailers to reach new customers via mobile.

Other highlights from the report include:

- Digital video advertising revenue reached $7 billion in the first half of the year, up 35% from a year ago, with 60% of this revenue attributed to mobile video

- Digital audio advertising grew 31% to reach $935 million in revenue in the first half of 2018, on track to exceed last year’s full-year revenue of $1.8 billion

- Mobile, which now accounts for nearly two-thirds (63%) of all digital ad revenue, continues to be the internet’s leading ad platform up from 54% of total revenues in half-year 2017

- Advertisers spent $30.9 billion on mobile media in the first half of 2018, up 42% from $21.8 billion over the same period last year

- Mobile search advertising also grew considerably to $13.5 billion, with an increase of 37% in the first half, while desktop search was flat at $9.3 billion

- Mobile search now accounts for 59% of total search revenue

- Mobile display ad revenue grew 45% to $11.7 billion in the first half of the year, accounting for 74% of all display ad revenue

- Social media revenue was $13.1 billion in the first half, up 38% year-over-year

“This landmark figure cements digital advertising—whether display, search or mobile video—as one of the most powerful mechanisms of all time for brands to build relationships with consumers,” said Randall Rothenberg, CEO, IAB. “It’s a truth upon which direct-to-consumer brands have built their businesses, and from which all businesses can benefit.”

“There is no question that digital advertising is top-of-mind with brand marketers,” said Anna Bager, Executive Vice President of Industry Initiatives, IAB. “Video is front and center, experiencing a surge—especially on mobile devices. Other formats, like digital audio and social media are seeing spikes and are ripe for further growth.”

“Half-year digital advertising spend in 2018 outpaced the last few years,” said Sue Hogan, Senior Vice President, Research and Measurement, IAB. “Typically, first half revenue trends lower than second half. That we’ve see 23 percent growth this year from January through June, while simultaneously witnessing the continued decline in ad spend on traditional media, indicates that the industry dollars—which were slow to follow actual consumer behavior—are now aligning appropriately.”

“Over the course of the last 23 years, this report has served as the official tracking mechanism of the size of the digital advertising industry and the trends propelling its ongoing rise,” said David Silverman, Partner, PwC US. “This 2018 half year report continues to drive awareness of the great influence of this industry, and specifically the great transformation that has occurred in the advertising ecosystem.”

IAB 2018 Half Year Report – Media Alert

Comparison of 2018 and 2017 Data (in millions)

| Revenue (Ad Formats) | Half Year 2018 | Half Year 2017 | ||

| % | $ | % | $ | |

| Search (Mobile and Desktop) | 46.1% | $22,823 | 47.5% | $19,134 |

| Banner (Mobile and Desktop) | 31.8% | $15,743 | 30.7% | $12,362 |

| Sponsorship | 0.9% | $451 | 1.0% | $388 |

| Rich media | 2.9% | $1,426 | 2.8% | $1,129 |

| Ad banners / display ads | 28.0% | $13,866 | 26.9% | $10,845 |

| Digital Video Commercials (Mobile and Desktop) | 14.2% | $7,012 | 12.9% | $5,203 |

| Other (Mobile and Desktop) | 8.0% | $3,963 | 8.8% | $3,551 |

| Classifieds and Directories | 3.2% | $1,597 | 3.8% | $1,525 |

| Lead Generation | 2.8% | $1,380 | 3.2% | $1,268 |

| Audio | 1.9% | $935 | 1.8% | $716 |

| Other (Mobile Other) | 0.1% | $51 | 0.1% | $42 |

| Total | 100.00% | $49,541 | 100.00% | $40,250 |

| Revenue (Desktop v Mobile) | Half Year 2018 | Half Year 2017 | ||

| % | $ | % | $ | |

| Desktop | 37.5% | 18,592 | 45.9% | $18,457 |

| Mobile | 62.5% | $30,949 | 54.1% | $21,793 |

| Total | 100.00% | $48,541 | 100.00% | $40,250 |

| Revenue (Pricing Models) | Half Year 2018 | Half Year 2017 | ||

| % | $ | % | $ | |

| Impression-based | 34.5% | $17,078 | 33.4% | $13,404 |

| Performance-based | 61.0% | $30,198 | 64.9% | $26,042 |

| Hybrid | 4.6% | $2,264 | 1.7% | $691 |

| Total | 100.00% | $49,541 | 100.00% | $40,138 |

* Digital audio advertising revenues have been revised for HY 2016 and HY 2017 to include Podcast advertising

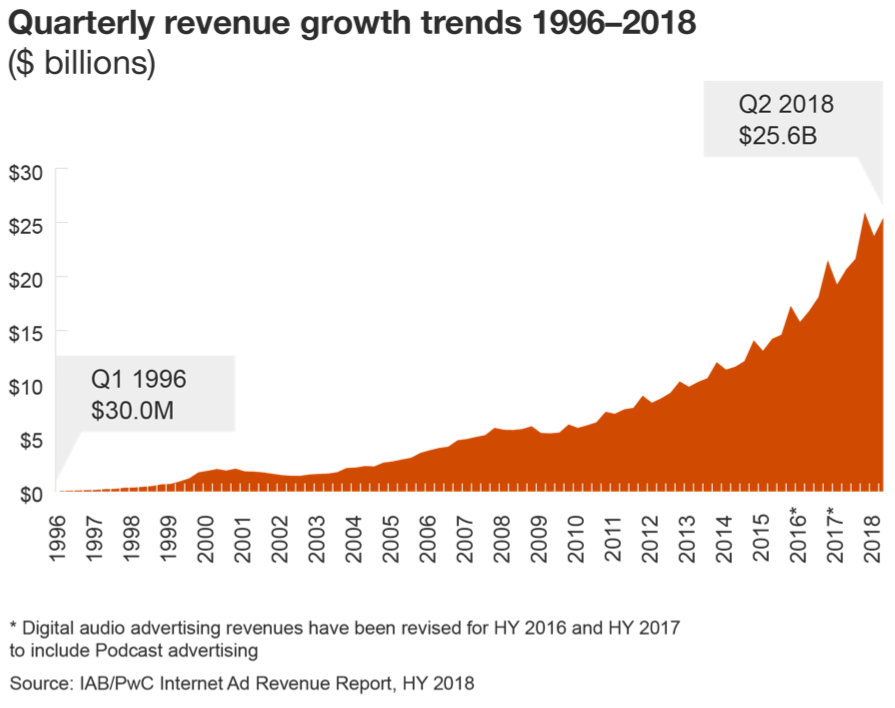

The following chart highlights quarterly ad revenue since IAB began measuring it in 1996; dollar figures are rounded.

|

IAB sponsors the IAB Internet Advertising Revenue Report, which is conducted independently by the New Media Group of PwC. The Q2 2018 revenue is estimated based upon a representative sample of the overall survey respondents. The results are considered a reasonable measurement of interactive advertising revenues because the data is compiled directly from information supplied by companies selling advertising on the internet. The survey includes data concerning online advertising revenues from web sites, commercial online services, free email providers, and all other companies selling online advertising.

PwC does not audit the information and provides no opinion or other form of assurance with respect to the information. Past reports are available at iab.com/adrevenuereport.

About PwC US

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 158 countries with more than 236,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com.

About IAB

The Interactive Advertising Bureau (IAB) empowers the media and marketing industries to thrive in the digital economy. Its membership is comprised of more than 650 leading media and technology companies that are responsible for selling, delivering, and optimizing digital advertising or marketing campaigns. The trade group fields critical research on interactive advertising, while also educating brands, agencies, and the wider business community on the importance of digital marketing. In affiliation with the IAB Tech Lab, it develops technical standards and best practices. IAB and the IAB Education Foundation are committed to professional development and elevating the knowledge, skills, expertise, and diversity of the workforce across the industry. Through the work of its public policy office in Washington, D.C., IAB advocates for its members and promotes the value of the interactive advertising industry to legislators and policymakers. Founded in 1996, the IAB is headquartered in New York City and has a San Francisco office.

IAB Media Contact

Laura Goldberg

347.683.1859

[email protected]

PwC Media Contact

Therese Quiao

202.281.9397

[email protected]