Perhaps the signal moment at Hubert Burda Media’s wonderful DLD Conference in Munich, Germany last week occurred on the morning of the second day. DLD — it stands for “Digital, Life, Design,” and the conclave is modeled in part on the venerable TED Conference, albeit with a distinctly European flair — has grown in only three short years into the premier event for all-things-interactive in Europe. It sports an eclectic mix of speakers and attendees (members of the European Parliament, fashion models who blog, famous architects, unknown Israeli physicists, et al) and is, truth be told, kind of wacky. Its diversity and centerlessness fits the culture of DLD’s sponsoring company: Burda is an extremely successful German periodicals publisher, among whose 260 properties are some of the largest news, womens’, and lifestyle magazines in Europe, yet whose attitude is less businesslike than familial. One of Burda’s core competencies is networking, and the annual DLD meeting networks together a curious and intriguing group, one absolutely devoted to touting the digital future. Needless to say, all speakers project that future to be quite rosy.

Which leads me to the moment in question. It occurred immediately after a swarm of speakers had completed their presentations to a packed house on, as the session titled it, “TV Reloaded.” The presenters were a gallery of latter-day interactive video stars: Dina Kaplan, co-founder and COO of Blip.tv; Suranga Chandratillake, CEO of Blinkx; Niklas Zennstrom, co-founder of Joost; and Patrick Walker, head of content strategy and partnerships for YouTube in Europe, the Middle East, and Africa.

Which leads me to the moment in question. It occurred immediately after a swarm of speakers had completed their presentations to a packed house on, as the session titled it, “TV Reloaded.” The presenters were a gallery of latter-day interactive video stars: Dina Kaplan, co-founder and COO of Blip.tv; Suranga Chandratillake, CEO of Blinkx; Niklas Zennstrom, co-founder of Joost; and Patrick Walker, head of content strategy and partnerships for YouTube in Europe, the Middle East, and Africa.

The panelists were fulsome about the imminence of traditional television’s defeat. “What we’re doing is very threatening to traditional TV networks,” declared Ms. Kaplan, whose company specializes in episodic online video programming. “Too much is exploding,” said Mr. Zennstrom (who, having helped to launch Skype, knows from explosive technologies). All this revolution needs to ignite it, Mr. Chandratillake suggested, is a way of navigating the new televisual cornucopia, and his company, a search engine with 18 million hours of video spidered and index, is that “next- generation remote control.”

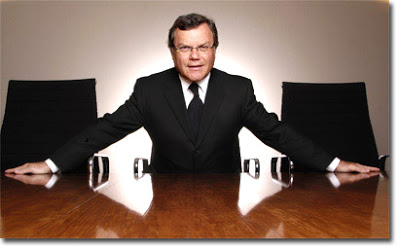

At which point the moderator handed the microphone to a gentleman in the front row. His name is Martin Sorrell, and he is the chief executive of the WPP Group, one of the world’s largest marketing communications companies, and an engineer of the megamerger phenomenon that transformed and globalized the advertising industry in the 1980’s.

“If there’s a phrase I loathe, it’s ‘business model,'” Sir Martin said. “In my company, we have 102,000 people working in 106 countries. Our world is made up of revenues, costs, profits, and cash flow. I’ve heard a lot from this panel on what will be. But we do an enormous amount of business, much of it growing, with broadcast and cable television networks around the world. Can each panelist precisely say what their revenues, profits, and cash flows are today, and what they will be in a few years?

“Please,” Sir Martin added, “be precise.”

Unfortunately, almost no one was.

To be fair, Mr. Chandratillake, whose Blinkx is publicly traded on the London Stock Exchange, did say that he expected the company to achieve revenues of some $4 million in its current fiscal year, with costs running at twice that — although, with IPO costs factored out, it would be close to break-even. But each of the others ducked. “In our first year, we came close to breaking even, mostly on software licensing,” Ms. Kaplan said. “We will be profitable this year.” Mr. Walker would say only that YouTube was rising “from low CPM’s to $10, $20 CPM’s,” but would not go further.

Get-Real Time

The reticence was, and is a shame. It is time to get real. The IAB’s Annual Meeting — which we are theming around the primary development of the past year, the emergence of new forms of competition and collaboration across the value chain, a phenomenon we term “Ecosystem 2.0” — is all about getting real, growing up… and grabbing share.

Make no mistake, we are entering into a reality-checking moment — the second in the 15 years since the Mosaic browser was launched, ushering in the modern Internet era. The first reality check was the bursting of the dotcom bubble in 2001-2002. Now, as then, we face a recession and a slowdown in marketer spend. Likely, too, is a tightening in the availability of investment capital, as financial institutions retrench in the wake of the subprime mortgage debacle.

But other factors are quite different. The dotcom bubble was fueled by public equity financing, with individual and institutional investors accepting mad valuations and buying shares based on insane metrics. The 2003-2007 growth surge, by contrast, was financed with real cash looking for real revenues and returns. Whereas the recession of 2002 included a technology-market collapse (in no small part because IT spend had been boosted artificially for years by Y2K compliance considerations), tech companies (telecoms excepted) look to be weathering this downturn, as businesses embrace the productive and connective power of Web-based communications.

Finally, it appears now to be universally accepted by all segments of our ecosystem — media, agencies, and marketers alike — that marketing-communications is becoming a fundamentally digital enterprise.

For the past four months, I have informally been asking IAB member executives the single most insistent question on all our minds: In the event of a recession or significant economic downturn, what happens to interactive advertising spend? Almost universally, they believe a recession will not hinder the continuing growth of our industry.

$60 Billion Path

One week ago, queried thusly at the annual Bear Stearns Virtual Advertising Summit, I reported that finding to the analysts in attendance. They agreed that a recession will prompt a flight to accountability, and considered compound annual growth rates of 25% between now and 2011 entirely feasible — leading to an industry that will reach $60 billion in U.S. revenues over the next four years. At that point, interactive will have become the nation’s largest ad-supported medium.

Certainly, the bets have been large — grand, even. Microsoft closed its $6 billion acquisition of aQuantive in August; CEO Steve Ballmer has said he expects a quarter of Redmond’s revenues eventually to derive from advertising. Google anticipates closing its $1.6 billion of Doubleclick within the next few months; its CEO, Eric Schmidt, recently told The New Yorker’s Ken Auletta that he believes Google now is “in the advertising business.” Sir Martin last summer paid $649 million for 24/7 Real Media, an online ad-network pioneer; 20 years earlier, WPP had paid about $100 million less (unadjusted) to acquire the entire J. Walter Thompson global agency network.

Certainly, the bets have been large — grand, even. Microsoft closed its $6 billion acquisition of aQuantive in August; CEO Steve Ballmer has said he expects a quarter of Redmond’s revenues eventually to derive from advertising. Google anticipates closing its $1.6 billion of Doubleclick within the next few months; its CEO, Eric Schmidt, recently told The New Yorker’s Ken Auletta that he believes Google now is “in the advertising business.” Sir Martin last summer paid $649 million for 24/7 Real Media, an online ad-network pioneer; 20 years earlier, WPP had paid about $100 million less (unadjusted) to acquire the entire J. Walter Thompson global agency network.

But Sir Martin’s call for precision in projecting, calculating, building and delivering is timely and apt. As the money — not just investor money, but advertiser money — gets large, there is a hunger for understanding and communicating the new rules of the road. What are the success stories? What is a fair price for value delivered? How will the new partnerships among agencies and media companies on behalf of marketers shape up? How will the regulatory environment affect our operations now and in the future? The people paying the bills want to know, and it’s incumbent on the interactive industry to provide answers.

The Interactive Advertising Bureau’s “Ecosystem 2.0” conference is designed to provide those answers, in an intimate setting where giants and startups can mingle together, leader to leader and team to team. This is the first industry gathering since last spring’s and summer’s explosive M&A activity to bring together the architects of media and marketing’s dramatic reshaping. The focus will be on how the evolving relationship among platforms, publishers, agencies, and marketers is adding value to the value chain — upstream, to the agencies and clients, and downstream, to branded content creators, analysts and insights generators, and service providers.

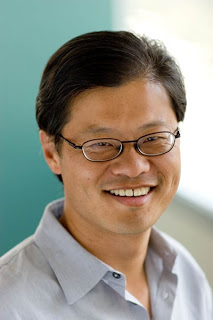

Yang, Falco, McAndrews

CEO Jerry Yang will keynote on Yahoo’s evolution as a platform — including its acquisitions of online ad exchange Right Media and ad network Blue Lithium. AOL CEO Randy Falco will sit down with me to describe the reasoning behind his acquisitions of the Tacoda behavioral targeting network and other networks, and the organization of a new ad platform business, appropriately named Platform A. Brian McAndrews, formerly aQuantive’s CEO and now Microsoft’s SVP of Advertiser and Publisher Solutions, will explain what he and his team have done to create cross-industry value in the six months since aQuantive climbed through Windows. Rob Norman, CEO of WPP’s Group M Interaction, will explain how ad agencies are adapting — and possibly leading — the transforming industry. Hulu Chief Executive Jason Kilar will describe vividly how online video is attracting consumers and advertisers now. With an introduction by Johnson & Johnson Global Media Officer Kim Kadlec, the chairman of Babycenter LLC, Tina Sharkey, will showcase how media companies are becoming “insights engines” for their customers. In her first major speech since leaving the top U.S. sales role at Yahoo for the media presidency of Martha Stewart Living Omnimedia, Wenda Harris Millard (IAB’s new chairperson) will outline a worldview shaped by alternate lives in a platform environment and in branded media.

CEO Jerry Yang will keynote on Yahoo’s evolution as a platform — including its acquisitions of online ad exchange Right Media and ad network Blue Lithium. AOL CEO Randy Falco will sit down with me to describe the reasoning behind his acquisitions of the Tacoda behavioral targeting network and other networks, and the organization of a new ad platform business, appropriately named Platform A. Brian McAndrews, formerly aQuantive’s CEO and now Microsoft’s SVP of Advertiser and Publisher Solutions, will explain what he and his team have done to create cross-industry value in the six months since aQuantive climbed through Windows. Rob Norman, CEO of WPP’s Group M Interaction, will explain how ad agencies are adapting — and possibly leading — the transforming industry. Hulu Chief Executive Jason Kilar will describe vividly how online video is attracting consumers and advertisers now. With an introduction by Johnson & Johnson Global Media Officer Kim Kadlec, the chairman of Babycenter LLC, Tina Sharkey, will showcase how media companies are becoming “insights engines” for their customers. In her first major speech since leaving the top U.S. sales role at Yahoo for the media presidency of Martha Stewart Living Omnimedia, Wenda Harris Millard (IAB’s new chairperson) will outline a worldview shaped by alternate lives in a platform environment and in branded media.

“Ecosystem 2.0” also will feature substantive debates:

- In an industry first, leaders of two online ad exchanges will challenge leaders of two branded media companies on one of our industry’s roiling controversies: whether networks and exchanges commoditize media and advertising.

- Booz Allen Hamilton U.S. Media& Entertainment Practice Leader Christopher Vollmer will unveil exclusive results from the consulting firm’s “Marketing-Media Ecosystem 2010” study, zeroing in on how media companies are competing and collaborating in the new interactive environment.

- In another first, a cross-ecosystem panel — leaders from Ogilvy, Meredith, IAC Corp., Google, and Federated Media, joined by the Chief Marketing Officer of Computer Associates — will respond to the study findings, grappling with who is disintermediating whom in the battle for revenues and share.

- The brewing regulatory battle over behavioral targeting — and its consequences for marketers and media — will feature in another panel.

The IAB Annual Meeting also will provide a chance for the interactive media industry to celebrate itself, in several surprising ways we will announce in a few weeks — not to mention in informal meals and at least a bit of partying.

With only a few hundred seats on offer, we anticipate an affair as comfortable as it is substantive. As unbridled opportunity and economic constraint collide, “Ecosystem 2.0” is what media, marketing, agency and service-provider executives need now: two-and-a-half days filled with news-you-can-use, sidebars for deal-making, and a chance to mingle with the leaders who are making a difference right now.