For many of us, our early imagination of a hi-tech future is marked by movie and cartoon images of autonomous cars, hovering over us. Though we haven’t yet seen a sky highway, cars have certainly held their own in this new age of digital media. As technology advances rapidly and we look to the future, we ask – What about connected cars?

To better understand the role of the Connected Car in the digital media space, we turned to our Connected Car Working Group, comprised of thought-leaders from AT&T, OUTFRONT Media, Nielsen, Purch, Jumpstart Automotive Media, GroupM, The Weather Company, and Cumulus Media. We began by asking:

What is a Connected Car?

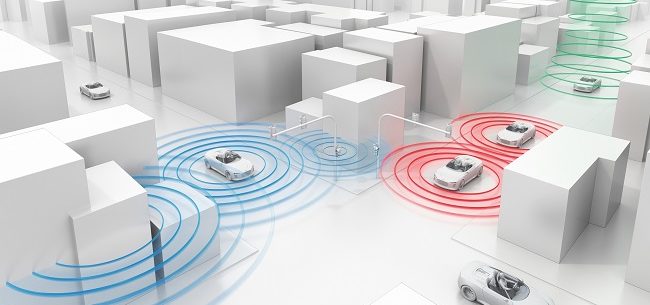

Though the responses vary slightly, the main feature our members highlighted is the ability of a car to connect to the internet and communicate data and media to and from the vehicle while in transit. We found that the differences in responses to our survey reflected the particular segment of the connected car ecosystem the respondents were coming from. Other features highlighted as defining a Connected Car include:

- Ability to communicate between components of the vehicle and the OEM (Original Equipment Manufacturer)

- Independently IP enabled

- Ability to link wireless devices to machine (another vehicle, parking meters, etc.)

- Ability to bring external data into the car environment to augment the driver and passenger experience

- Ability to send data to third parties

Regardless of minor variations in definition, all respondents agree that the Connected Car—as a rolling media environment–provides high value to advertisers. The top 3 agreed-upon opportunities include 1) an enhanced ability to reach a targeted (indeed, captive) audience, 2) more insightful data for user segmentation, and 3) new forms of location-based marketing. Other prospective benefits include in-vehicle and cross-screen targeting, as well as point-of-sale/last mile attribution metrics for brands.

We also asked the group for their thoughts on how they anticipate the connected car advertising experience will evolve. Nearly all respondents agreed that the most likely in-vehicle ad experiences will involve voice/audio, as well as static images and display formats. Video was also considered highly likely, although less than the former options since it is mainly specific to cars that are driven fully autonomously.

Opportunities and Challenges of Connected Car Marketers

In anticipation of these opportunities, we wanted to gauge which metrics will be key performance indicators for the industry. With many of our respondents envisioning multiple opportunities for media and advertising measurement across many parts of the ecosystem, we found a range of core KPI’s are being considered. The top 3 include time spent, impressions delivered, and aggregated GPS/location data. It’s expected several other metrics will prove to be vital as well, such as viewability, cross-platform impressions, usage levels of various features, audio/radio metrics for in-car, and reach/extension of existing digital media currency metrics.

Acquiring uniform data to support these metrics in a standard and consistent format was highlighted by the group as a key roadblock in the growth of the media opportunity for Connected Cars. Key questions include who collects, manages, and owns the audience data, and how will it be distributed. Assumptions about how to measure reach, time spent, and viewability will also be called into question in this fast moving space. The group also highlighted privacy and consumer data protection as potential issues to address within the context of industry self-regulation and government oversight. Other, more granular metric related issues include how to identify unique users–especially as car sharing becomes more common. User experience issues come into play as well, such as slow connectivity, user centric creative execution, and ensuring development of quality user experiences and thus avoiding issues of consumer opt-out and ad avoidance (a growing concern especially in the display advertising space). With these challenges to overcome, the group expects the Connected Car to see rudimentary in-vehicle advertising solutions in the coming year, with improvements in the years to come as the Connected Car becomes more ubiquitous.

What’s Next?

As the digital media industry continues to evolve, IAB will follow closely to ensure insights around new and emerging consumer experiences such as the Connected Car, Digital Out of Home, and the “Internet of Things” are brought to the attention of our members. Upon surveying our Connected Car Working Group, we can see that mobile, video, and traditional audio metrics will play an important part in the development of Connected Cars media opportunities. We can also see that Connected Cars will prove equally valuable as a growing ecosystem and platform for the rest of the industry, especially given its potential to fill in many important gaps in our understanding of the customer journey, from digital media to ecommerce and in-store purchase. Though our cars may not yet be hovering mid-air, zipping back and forth overhead, it’s safe to say the time of the Connected Car is quickly approaching!