Outlook for Digital Video Ad Spend Expected to Outpace Linear TV in 2021

New York, May 4, 2021 – Digital video advertising growth continues, and is expected to represent more than half (56%) of total video spend projected in 2021. Connected TV (CTV) continues to outpace other formats and shows no signs of slowing down, according to IAB’s “Video Ad Spend 2020 and Outlook for 2021” report, released at the IAB 2021 NewFronts.

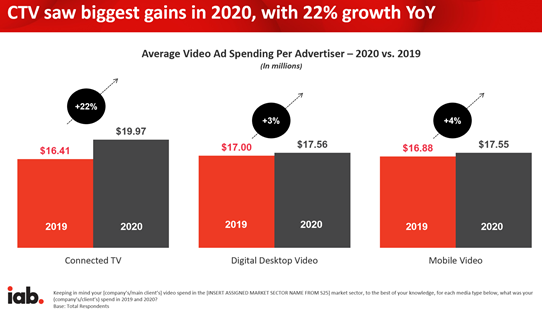

CTV saw its highest gains to date in ad spend in 2020: 22% growth year-over-year

Nearly three quarters (73%) of CTV buyers report shifting budget from broadcast and cable to CTV in 2021. Advertisers, on average, spent $20M on CTV in 2020, and more than a third (35%) of buyers expect to increase CTV video ad spending in 2021.

“This is a bellwether moment in media that reflects the continued acceleration and shift to digital,” said Eric John, VP of IAB Media Center. “While we are seeing growth across all digital video, the movement to more audience-based buying approaches has resulted in increased buyer demand for CTV.”

Buyers cite premium, high quality content, as well as targeting, and brand safety as the key benefits of CTV. Sixty percent of advertisers rated CTV highly on providing “a trusted, brand safe environment,” and nearly half (46%) cite targeting as a key benefit of CTV. In terms of expected category-specific spend on CTV in 2021, buyers are optimistic for Health and Wellness (+144%), Finance (+97%), Travel (+92%), Telecom (+71%), and Media and Entertainment (+48%). When it comes to mobile, buyers expect to increase spend in Health & Wellness (+181%), and in Fashion / Apparel (+81%) as well.

“Viewers have come to expect optimized video experiences. The days of dog-owner households seeing cat food ads are ending, even on the big screen,” said John. “Flexibility, addressability, and the opportunity to reach specific audiences in real time has put streaming at the big kids table, in some cases at the head of the negotiation table, right alongside traditional linear.”

More than three quarters of advertisers say “robust first-party data” is important

Escalation of the audience-based buying trend and the impending loss of third-party identifiers makes first-party data a critical differentiator: more than three quarters of advertisers indicated that “robust first-party data” is important when selecting video partners.

“This year’s study shows us that advertisers are looking to buy video in the ways that people are actually watching it. We now have the ability to move beyond legacy demo-based approaches to reach the specific audiences that matter most to brands. Publishers that offer more addressability and robust first-party data, while effectively measuring results, will win the day,” concluded John.

“Video Ad Spend 2020 and Outlook for 2021” can be downloaded here.

Methodology

The research was conducted by Advertiser Perceptions, which surveyed 350 marketer and agency executives online from March 19 – April 5, 2021. Qualified respondents have decision-making responsibilities for video advertising, spending a minimum of $1 Million in 10 key industry verticals.

About Advertiser Perceptions

Advertiser Perceptions is the global leader in research-based business intelligence for the advertising, marketing, and ad technology industries. Our expert staff delivers an unbiased, research-based view of the advertising market with analysis and solutions tailored to each client’s specific KPIs and business objectives. These insights provide the confidence to make the very best organizational, sales, and / or marketing decisions, driving greater revenue and increased client satisfaction.

About IAB

The Interactive Advertising Bureau empowers the media and marketing industries to thrive in the digital economy. Its membership comprises more than 650 leading media companies, brands, and the technology firms responsible for selling, delivering, and optimizing digital ad marketing campaigns. The trade group fields critical research on interactive advertising, while also educating brands, agencies, and the wider business community on the importance of digital marketing. In affiliation with the IAB Tech Lab, IAB develops technical standards and solutions. IAB is committed to professional development and elevating the knowledge, skills, expertise, and collaboration of the workforce across the industry. Through the work of its public policy office in Washington, D.C., the trade association advocates for its members and promotes the value of the interactive advertising industry to legislators and policymakers. Founded in 1996, IAB is headquartered in New York City.

IAB Media Contacts

Kate Tumino / Brittany Tibaldi

212-896-1252 / 347-487-6794

[email protected] / [email protected]