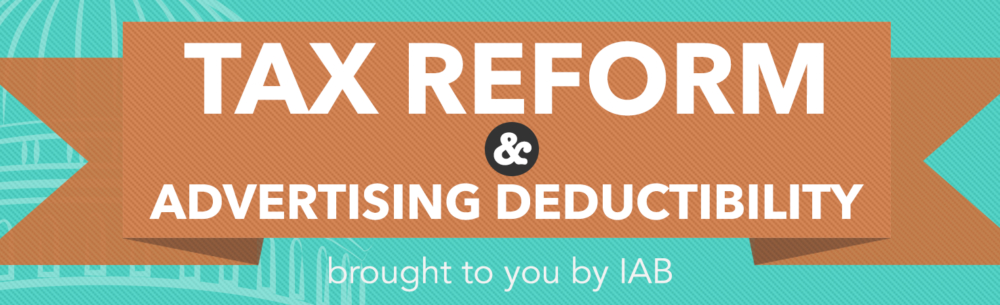

Tax Reform is a favorite topic among pundits & politicians alike. Though Democrats & Republicans may go about it differently, if you want to lower rates, you need big dollars.

With online advertising revenues soaring, eliminating the tax deductibility of advertising is squarely in their sights.

How is Advertising Currently Treated?

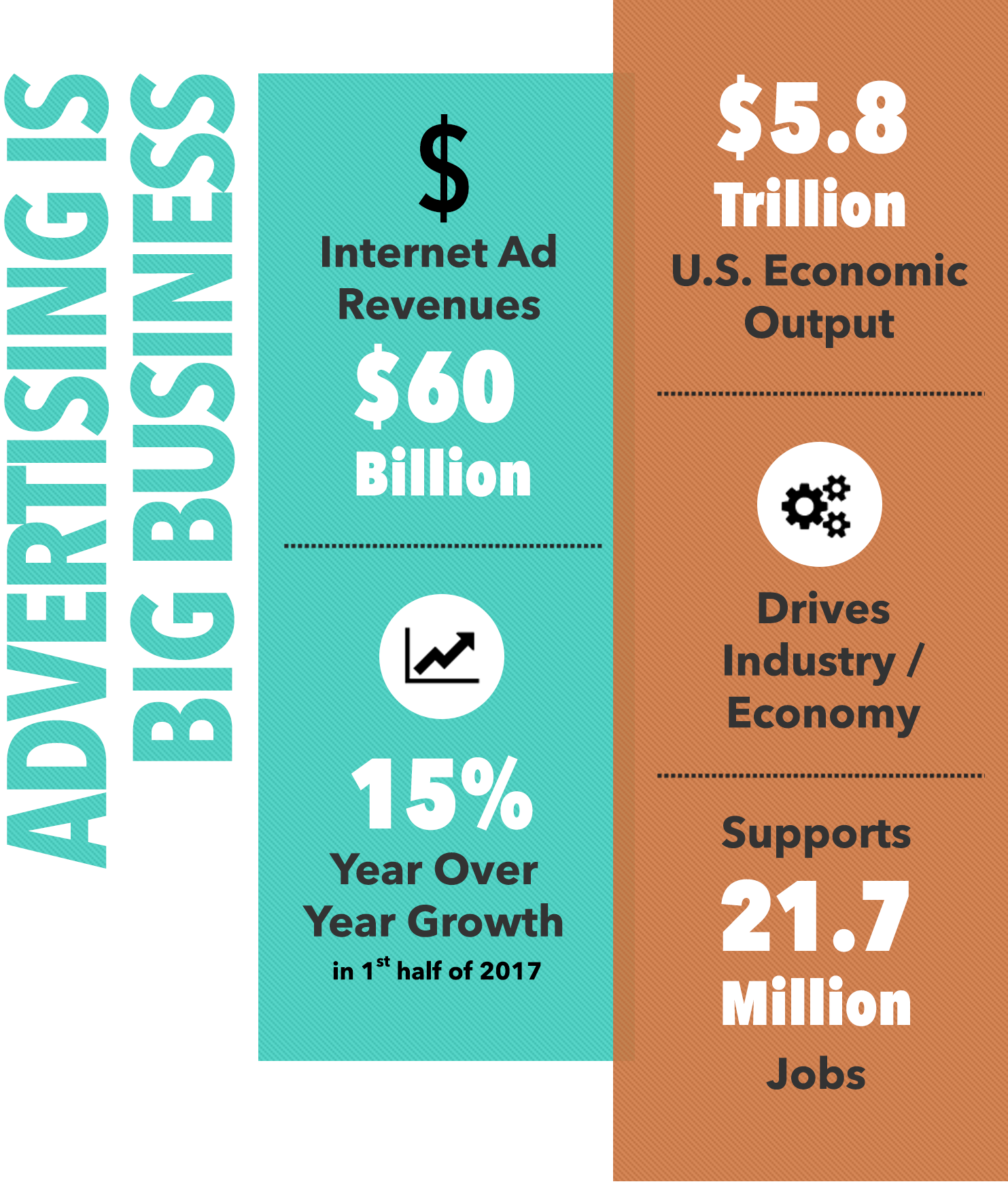

For 100 years, advertising has been fully deductible—just like rent, salaries, and office supplies. In IRS parlance it is an “ordinary & necessary” business expense. Using a very simple example, IAB wants to advertise its new product, the 2017 iabPHONE, and spent $1,000 on advertising.

In a simple example:

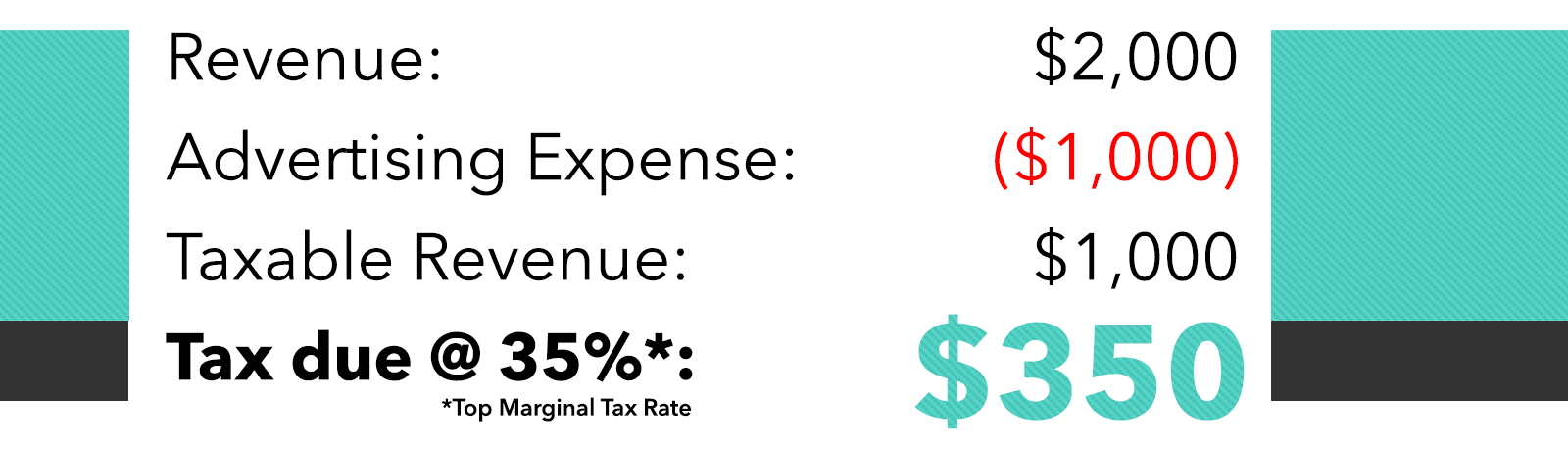

What’s the New Plan?

The House Tax Plan—A Better Way—proposes a 20% corporate rate and a 25% rate for pass-through businesses. It funds the cuts with a border adjustment tax. The BAT taxes imports and U.S.-made goods sold domestically but not U.S.-made goods sold abroad.

So How Does This Impact Advertising Deductibility?

The Better Way Plan includes immediate write-off of business investments and it’s unclear if this includes advertising.

And what about the opposition to the Border adjustment tax. What happens if that plan falls apart?

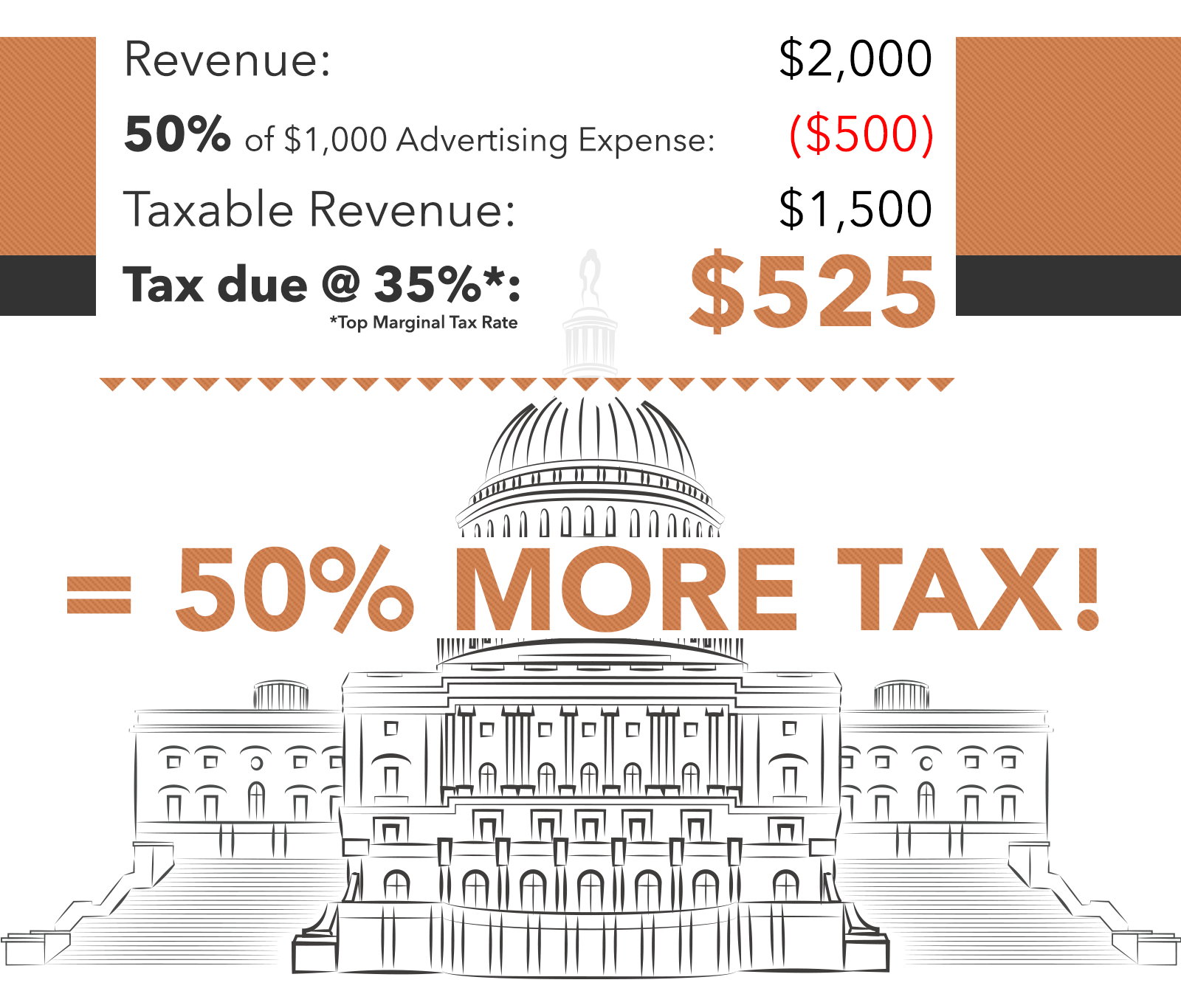

Legislators would need to find revenue to pay for the rate cut. These are known as “Pay-For’s”. Previously, both the House and Senate discussed proposals that would amortize 50% of advertising expenses. How would that work? Let’s go back to our iabPHONE example.

Even crazier? Under a previous House proposal, the remaining 50% ($500 in our example) that was not deducted in 2017, would be spread out over 10 years ($50 every year), so you would finish deducting your advertising for the 2017 iabPHONE in 2027 (probably 10 models later!)

According to the Joint Committee on Taxation, this provision would increase revenues by $169.0 billion—big dollars even by Washington standards.

What does this mean for the digital advertising industry?

If advertising becomes more expensive, advertisers will reduce their spending to keep their bottom lines intact. Even a small reduction could have a BIG impact.

If advertisers reduced their spend just 5%, that’s $3 billion gone – overnight.

To learn more or hear how you can help, email [email protected]