REVENUE TOTALED $1.6 BILLION FOR Q4 2002 – Up 9 Percent from the Third Quarter 2002

Keyword Search Continues Growth Trend – Triples Revenues in 2002

New York, NY (June 12, 2003) – The Interactive Advertising Bureau and PricewaterhouseCoopers today released the Internet Ad Revenue Report including final figures for fourth quarter and full year 2002. These final figures demonstrate an even more pronounced improvement in both year over year and quarter over quarter revenue results than the estimated numbers released in April 2003, with Internet advertising revenue in the U.S. totaling $6.0 billion for full-year 2002, down 16 percent versus 2001. Internet advertising revenue totaled $1.6 billion for the fourth quarter of 2002, up from the previous fourth-quarter estimate of $1.5 billion, and up 9 percent from the third quarter 2002. The increase in 2002 fourth quarter actual revenues from the previous estimate primarily reflected stronger than expected results from the top ad sellers.

The Interactive Advertising Bureau (IAB) sponsors the Internet Ad Revenue Report, which is conducted independently by the New Media Group of PricewaterhouseCoopers (PwC). The full report is issued twice yearly for full and half year data and top-line quarterly figures are issued for the first and third quarters. IAB issued top-line 2002 revenue figures in April 2002 with a caveat stating that the full report would be issued this month. The full report is available upon request to the IAB.

“We are very encouraged by the strong revenue results for the second half of 2002. This data supports the anecdotal information and other signs that are resulting in impressive balance sheets for most of the top ad sellers and we think the industry is positioned to experience incremental and sustained growth over the next few years,” said Greg Stuart, President & CEO of the Interactive Advertising Bureau (IAB). “The media landscape has changed and advertisers are smartly taking advantage of this evolution to build and reinforce relationships with their customers as they go online to shop, date, purchase travel, search for information, in essence, as they become increasingly more reliant on the Internet.”

“A number of factors that had been negatively impacting revenue growth seem to be turning favorable, including a modest rebound in overall advertising spending. Also, sellers are no longer cycling through lost revenue from the dot com fall-out, and the sharp growth in high-speed Internet access adoption is providing more opportunities for large traditional brand advertisers to experiment with the successful larger and more creative ad formats,” said Pete Petrusky, Director, New Media, PricewaterhouseCoopers.

“History shows that advertising ultimately follows the audience, and with 66% of all Americans having regular access to the Internet, we believe advertising budgets will continue to shift more online as long as the online medium continues to gain share of overall media consumption,” said Tom Hyland, Chair, PricewaterhouseCoopers New Media Group.

The 2001 and 2000 full year revenue data were adjusted to reflect revenue restatements reported in public filings by several individual companies. Those reported restatements totalled $77 million in 2001 and $138 million in 2000; historical revenue figures are now adjusted to $7.134 billion in 2001 and $8.087 billion in 2000. The IAB and PricewaterhouseCoopers will continue to report future restatements as filed by individual companies, and assess their impact on historical industry data.

This year’s report contains breakouts detailing the performance of particular industry segments. These include:

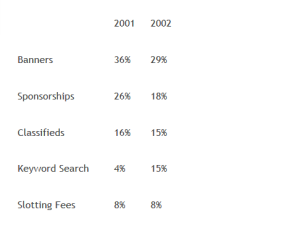

Ad Formats – Keyword search continued to demonstrate its strength as the lead indicator of growth for the overall interactive ad industry, representing 15% of ad revenues in 2002 – more than tripling its stake over 2001. 4Q 2002 keyword search revenue share was even more prominent, earning 21% of total ad format revenues. Sponsorships and banners were affected by the termination of several long-term deals involving ad sellers, coupled with sharp increases in emerging ad formats. Internet ad revenues broken down by ad formats for 2002 full year revenue are:

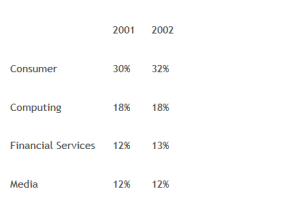

Ad Categories — In 2002, consumer advertisers continued to spend the most dollars on online advertising (32%). Retail consumer advertisers are the largest segment (42%) in the major consumer category.

Pricing Models — The CPM pricing model continues to be the predominant choice, comprising 45 percent of all deal revenues in 2002 (down from 48 percent last year), while straight performance deals were at 21 percent (up from 12 percent last year), and hybrid deals, a combination of CPM and performance declined to 34 percent (down from 40 percent last year).

About the Interactive Advertising Revenue Report

Conducted by the New Media Group of PricewaterhouseCoopers on an ongoing basis, with results released quarterly, the “Advertising Revenue Report” was started by the IAB in 1996. The results reported are the most accurate measurement of online advertising revenues because the data is compiled directly from information supplied by companies selling advertising on the Internet. All-encompassing in nature, the survey includes data concerning online advertising revenues from Web sites, commercial online services, free e-mail providers, and all other companies selling online advertising.