New IAB Study Finds That Higher-Income Americans—Hardest to Reach Via Traditional Media—More Likely to Be Aware of New Products, Companies and Sites After Viewing Online Ads

NEW YORK, NY (August 1, 2011) — The wealthiest American consumers, those in homes with at least $100,000 annual incomes, have long been difficult for marketers to reach through traditional media like TV and radio, but “Affluent Consumers in a Digital World,” a study from the Interactive Advertising Bureau (IAB) finds these higher-income Americans embracing digital media—and its ads.

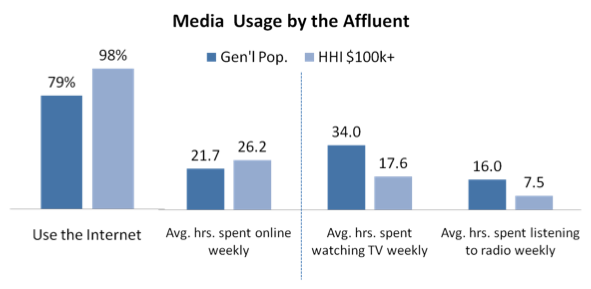

The study, conducted for the IAB by Ipsos Mendelsohn, which has been surveying the affluent market since 1977, found that 98 percent of affluent consumers use the Internet, as compared with 79 percent of the general population. They spend 26.2 hours online weekly, 17.6 hours watching TV and 7.5 hours listening to the radio. The general population, on the other hand, spends about twice as much time weekly with TV and radio—34 hours and 16 hours, respectively—and just 21.7 hours on the Internet.

“Affluents have long been one of the hardest to reach and most important consumer groups,” said Sherrill Mane, Senior Vice President of Industry Services, IAB. “They’re now more important than ever—not only do they control most consumer spending power, but they may be the key to leading our economy out of the recession. And the new research shows that when it comes to digital media, the old paradigm has been superseded: the wealthiest Americans use digital media far more than their less affluent counterparts.”

According to the survey, affluents overall currently comprise 21 percent of U.S. households, have 70 percent of all consumer wealth, and spend 3.2 times more than other Americans on purchases.

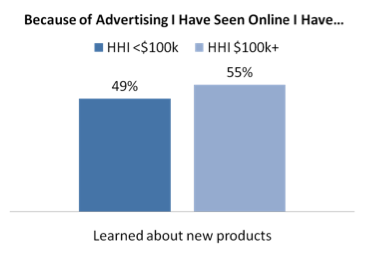

Compared with non-affluent consumers, affluent consumers are also somewhat more likely to be aware of new products (55% vs. 49%), new companies (51% vs. 49%), and new websites (46% vs. 44%) after viewing digital ads.

In addition, 59 percent of affluent consumers reported taking action based on a digital ad during the preceding six months. “While that number doesn’t differ significantly from other Internet users, it is of great significance to advertisers seeking to reach this elusive, yet important, market segment,” said Mane. “The combined reach, exposure and influence of digital as an ad vehicle to affluent households is simply unprecedented.”

The receptivity of affluent Americans to digital advertising is underscored by their greater understanding of the ad-supported web model and the benefits of ad targeting, as compared with non-affluent consumers:

- 32 percent of affluents vs. 23 percent of non-affluents said they’d be willing to share information about themselves in order to “get a more customized online experience.”

- 72 percent (vs. 61%) agreed with the statement, “Most websites are free because they are supported by advertising.”

- 57 percent (vs. 51%) said they would “prefer to see ad-supported online content that is free, rather than paying for content that is ad-free.”

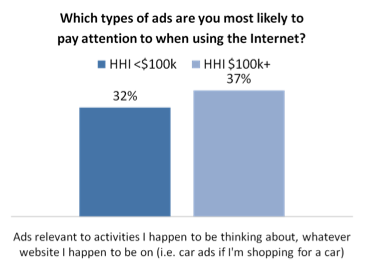

Part of what affluent consumers want (37% vs. 32% for non-affluents) from that customized experience are ads relevant to their current shopping interests—ie., auto ads if they’re ready for a new car, airline ads if they’re planning a trip—wherever they may be on the Internet.

“Affluent consumers have increasingly come to desire relevant and customized experiences, in part because they are living technology-infused lifestyles,” said Bob Shullman, President of Ipsos Mendelsohn. “Virtually all the affluent are online. Their ownership of tablets and e-readers has increased by 50 percent over the past six months, and shows every indication of continued growth. They have come to expect the benefits of digital media, even if it doesn’t alleviate all work-life pressures.”

Affluent Americans are twice as likely as the general population to own smartphones (33% vs. 17%), and seventy-nine percent of the affluent say their lives have become “intertwined with technology” over the past decade. However, they are more likely to say that their lives have become “more complicated” (59%) and “more stressful” (58%), as opposed to “more fun” (47%) or “easier” (33%).

The study was conducted online in the period February 22-28, 2011. Respondents consisted of a national sample of 2,088 online adults 18+, with 1,025 from households with $100,000 or more annual incomes, and 1,063 from households under $100,000.

For a full summary of the study, please go to www.iab.net/AffluentConsumers.

About Ipsos Mendelsohn

Ipsos Mendelsohn, a division of Ipsos OTX MediaCT, specializes in providing media and marketing insights to clients interested in better understanding the upscale segments of the American consumer marketplace. Conducting high-quality media and marketing research, Ipsos Mendelsohn has been reporting on the demographic, behavioral, and attitudinal characteristics of the American affluent population for the past 34 years in its syndicated offering, The Mendelsohn Affluent Survey. Because of its accumulated expertise in delivering insights into the passions, behavior, and attitudes of this highly valued marketplace, Ipsos Mendelsohn is recognized internationally as the definitive research source for the media habits and lifestyles of the affluent marketplace in the United States.

About the IAB

The Interactive Advertising Bureau (IAB) is comprised of more than 500 leading media and technology companies that are responsible for selling 86% of online advertising in the United States. On behalf of its members, the IAB is dedicated to the growth of the interactive advertising marketplace, of interactive’s share of total marketing spend, and of its members’ share of total marketing spend. The IAB educates marketers, agencies, media companies and the wider business community about the value of interactive advertising. Working with its member companies, the IAB evaluates and recommends standards and practices and fields critical research on interactive advertising. Founded in 1996, the IAB is headquartered in New York City with a Public Policy office in Washington, D.C. For more information, please visit iab.com.

IAB Media Contact

Laura Goldberg

347.683.1859

[email protected]