Accelerating Growth in The Direct Brand Economy Revolution

Let’s not mince words: 2018 was a year of massive disruption by any measure—and all signs point to this disruption accelerating in 2019 and beyond.

Let’s not mince words: 2018 was a year of massive disruption by any measure—and all signs point to this disruption accelerating in 2019 and beyond.

For over a century, dominant consumer-facing companies created value through their ownership and operation of high-barrier-to-entry, capital-intensive supply chains. The most successful companies owned outright or had significant control over every major function within their supply chain, from the sourcing of raw materials to the ownership of their factories and warehouses, to the railway cars and trucks that got their goods to market.

Today, all that has been upended. We are in the midst of a shift from a century-old indirect brand economy to a direct brand economy.

Brands characterized by their direct connections to consumers are disrupting the business model of market-leading brands, which is leading to a whole new way of doing business.

These direct brands are digitally savvy, fueled by data, and are the growth engine of the new economy.

What’s propelling this new world order is the cloud-based internet. The cloud has taken the increasingly finely-tuned ability to manage supply and demand across borders, and enabled it to segment down to the individual level. For the first time, it became possible for customers to make demands of companies as individuals—and to have those demands fulfilled.

In this new economy, 21st century brands create value by tapping into a low-barrier-to-entry, capital- flexible, leased or rented supply chains. And they extract that value through a multiplicity of fulfillment models, all of which have a single thing in common: they aim to create a mutually beneficial, two-way relationship between the brand and the consumer, because that interactive relationship throws off the data that is the central competitive element for every other function in the enterprise.

We see no reason to believe this direct brand economy will slow down, let alone go into reverse. This “stack-your-own supply chain” is now so advanced and so embedded in the economy that the trends we’ve seen for the past decade will only accelerate.

It also represents an incredible opportunity for those who understand the power of interactive media in this new world order.

Digital advertising—whether display, search, or mobile video—is one of the most powerful mechanisms of all time for brands to build relationships with consumers. It’s a truth upon which direct-to-consumer brands have built their businesses, and from which all businesses can benefit.

To succeed in this new economy, you must become a direct brand, or serve the needs of direct brands, or help incumbent brands adapt and thrive in this new environment. And what they need more than anything else is to create more, and more enduring, two-way relationships with their consumers. Creating those data-enriched relationships most certainly requires technology, but it also requires storytelling, essential for the three last mile gaps that must be closed: to the home, to the head, and to the heart.

We have committed IAB to advancing this framework—and to helping our members navigate this exciting but precarious evolution in the way brands and consumers interrelate. What you’ll see in the pages that follow are highlights of the initiatives we undertook in 2018 on our members’ behalf—as well as what lies ahead.

We look forward to helping all parts of our industry thrive in the direct brand economy in 2019 and beyond.

Sincerely,

Randall Rothenberg

Chief Executive Officer, IAB

Playing by The New Rules: Data Governance, Ethics, And Legislation

Data is to the 21st century what capital was to the 20th century. If you doubt that, consider this: In 2018, American companies spent nearly $19.2 billion on the acquisition of audience data and on solutions to manage, process, and analyze digital audience data—a figure that represents a staggering 17.5 percent increase from the prior year (State of Data 2018 Report, Winterberry Group, IAB).

Data is to the 21st century what capital was to the 20th century. If you doubt that, consider this: In 2018, American companies spent nearly $19.2 billion on the acquisition of audience data and on solutions to manage, process, and analyze digital audience data—a figure that represents a staggering 17.5 percent increase from the prior year (State of Data 2018 Report, Winterberry Group, IAB).

This is the current data landscape—and the elephant in the room.

Our industry is at the center of a seismic change in the ways people engage with the world around them. Up-and-coming direct-to-consumer brands in particular are built around data and leveraging it: They create value by creating a mutually beneficial, two-way relationship between the brand and the consumer, a relationship that involves data that is vital to every part of the business. Because of this relationship with consumer data, we can intimately understand the motivations of many consumers—a double-edged sword that brings immense value to the marketplace, but has also unleashed many problems that must be addressed head on.

Consumers know we’re collecting their data and they care about what we’re gathering and how we’re using it. It’s time for our industry to embrace transparency about what data we’re collecting and why. We need to give consumers control to decide what to share and not share. We need to make sure we get our governance right. And we need to have good ethics built into our thinking.

These are the new rules as data becomes more important and more valuable—and collectively we need to be good stewards of that data in how we use and protect it.

If we don’t, more legislation and regulation like the EU’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) will be on the way. In fact, many states are already considering their own regulation—and we need to prepare for that.

If you don’t have consumers’ trust, you won’t get their data. And without data, you don’t have a business.

IAB is investing in helping our members and the industry navigate this new landscape with research around the state of data and trends as well as analyzing where companies are spending money and where they’re going. Our public policy and legal teams are managing the risk around regulation. And IAB is developing training and playbooks to help companies understand this profound digital transformation.

In 2019 we’ll be focusing heavily on developing resources for our members to understand the role of data in the direct brand economy including the nuances of insourcing programmatic advertising, using data responsibly to ensure brand and consumer safety, and how to use data to engage with 21st century consumers.

Our industry is big and intimate—and with great power comes great responsibility. It’s time to get to work.

Respectfully,

Patrick Dolan

President & COO, IAB

2018 Highlights

IAB’s mission is to empower the media and marketing industries to thrive in the digital economy. This report covers some of the important work IAB has engaged in to deliver on this mission and to respond to the rapidly changing digital media landscape. Below please find highlights from our main areas of focus in 2018:

IAB’s mission is to empower the media and marketing industries to thrive in the digital economy. This report covers some of the important work IAB has engaged in to deliver on this mission and to respond to the rapidly changing digital media landscape. Below please find highlights from our main areas of focus in 2018:

- Industry Advocacy in Washington D.C. and Beyond

- Thriving in a New Direct-to-Consumer World

- Fighting Fraud and Promoting Brand Safety

- Driving Industry Growth through Automation

- Navigating Digital Video Convergence

- Developing Talent-Rich Organizations

Industry Advocacy in Washington D.C. and Beyond

Over the past year, we have seen headline after headline about problems such as misuse or lack of security relating to digital data. It is therefore not surprising that in the U.S. and around the world, policymakers are pushing legislation and regulations to tightly regulate data usage.

While we have advocated for sensible regulation, the solutions currently being offered up are often so draconian that they threaten to kill or cripple the digital media industry. Whether it is testifying on behalf of our members in Congress or working to help our members testify, IAB has been at the forefront of addressing the increased scrutiny policy makers have of our industry. The IAB policy team, with the help of IAB members, has worked to minimize the impact of the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and the host of new federal and state level laws that are working their way through drafting committees. IAB will continue to be a strong force for policy and advocacy on behalf of our members at the federal, state, and global level in support of consumer privacy, data security, supply chain safety, advertising taxation, and other major regulatory and legislative issues.

Thriving in a New Direct-To-Consumer World

To explain the seismic new shift from an indirect brand economy to a direct brand economy and the opportunities for brands, marketers, and publishers, at IAB’s Annual Leadership Meeting in February 2018, IAB released research on economic conditions that are fueling the growth of brands that have direct relationships with consumers. The Rise of the 21st Century Brand Economy research identifies how and why more brands are taking control of their relationships with consumers through data, storytelling, and e-tailing and has provided a unique opportunity to engage with brands on a new level by putting digital marketing practices at the core of the conversation.

Throughout 2018, IAB brought brands into the room, specifically digitally native vertical brands to spark conversations for our members and the industry with these functional experts at the forefront of the direct brand revolution.

To help every company in the value chain and our members learn and adapt, the IAB Brand Council was and will continue to be a central location for research, development, and networking to help every company in the value chain learn and adapt.

In 2018, IAB also appointed media and marketing veteran Jim Norton as the trade group’s latest Executive-in-Residence. A publishing world thought leader and former Chairman of the IAB Board of Directors, Norton is leveraging his extensive experience with premium content brands to move forward the direct brand economy initiative. He has been working with IAB leadership to educate members and incumbent brands on how to rethink strategy to thrive in the direct brand economy. He also played a key role in shaping the agenda for the IAB Direct Brand Summit which debuted in October in New York City. The Direct Brand Summit is the first and only conference dedicated to direct-to-consumer brands and the direct brand economy.

Helping our members thrive in the direct brand economy was a key theme through initiatives and activities across IAB in 2018 and we expect to continue that in 2019.

Fighting Fraud and Promoting Brand Safety

This year’s spate of data and privacy revelations (and subsequent Congressional hearings) have forever changed the conversation about consumer data and privacy. We’ve known for years in the advertising industry that bots are a problem. But the industry was focused on bot fraud aimed at stealing money out of people’s pockets. What we didn’t know then—and what’s happening now—is we are finally recognizing that this is serious business, that people can get hurt from bad communications in the same way they can get hurt from bad grains in food or bad parts in cars.

To lead the industry toward a more transparent and secure supply chain, the IAB Tech Lab and the IAB Data Center of Excellence continue to invest in essential resources for our members such as ads.txt, the Open Measurement Software Development Kit (OM SDK), the Trustworthy Accountability Group (TAG) Registry and more—all in service of this mission for our members and the industry.

To help companies and our members become more data-centric, and understand where U.S.-based marketers, publishers, and others invested more than $20 billion in data in 2017, the Data Center of Excellence launched a five-city data roadshow titled Data Demystified in May in San Francisco, leveraging the results from the Data Centric Organization and Data Marketing Sizing Research.

On the policy front, as Congress is looking into the events surrounding the revelations about Facebook and Cambridge Analytica, IAB’s Washington D.C. policy office continued to deliver a holistic story and message for our members about the digital advertising industry. During dozens of meetings before the hearings, legislators were reminded about the robust self-regulatory programs in place, the significant economic value of the digital advertising industry, and the way in which our members responsibly handle consumer data. We expect these efforts to ramp up considerably in 2019.

IAB believes that self-regulatory models, coupled with well-reasoned sectoral laws focused on concrete consumer harm, have improved consumer protection, privacy, and security over the past twenty plus years, while also promoting innovation and growth in the modern internet-enabled economy and we continue to support these efforts on our members’ behalf.

Driving Industry Growth Through Programmatic

Despite the complexity of today’s digital supply chain, automation will continue to refine buying and selling processes and shift attention to higher-value marketing and advertising functions. Automated platforms and services can continue to drive industry growth through increasingly relevant and effective advertising, flexible publisher monetization opportunities, and enhanced consumer experiences.

Instead of relying on the false dichotomy of defining overall buying and selling practices as “programmatic” or not, IAB recommends acknowledging the broader and deeper implications of automation on the media industry, and proposes a framework rooted in the digital supply chain processes and tasks that can be partially or fully automated. The aim is to provide a common vocabulary and structure to:

- Promote informed conversations among buyers, sellers, and vendors-supporting evaluation, negotiation, and activation of platforms and tools that can enable effective advertising

- Highlight areas where automation hasn’t yet been enabled, beyond the scope of what may have been considered “programmatic” historically

- Support consistent benchmarking of marketplace sizing, investment, and attitudes

To help our members and the industry define the different types of solutions that can help take charge of programmatic platforms, the IAB Data Center of Excellence leads the industry understanding of the in-housing programmatic trend that many marketers and brands are undertaking.

Navigating Digital Video Convergence

In 2018, original digital video (ODV) reached 86 million Americans, 13 years and older, among which 72 million are adults (18+). ODV viewership among American adults has been on a steady rise from 45 million in 2013 to 72 million in 2018, a 60 percent increase.

In 2018, original digital video (ODV) reached 86 million Americans, 13 years and older, among which 72 million are adults (18+). ODV viewership among American adults has been on a steady rise from 45 million in 2013 to 72 million in 2018, a 60 percent increase.

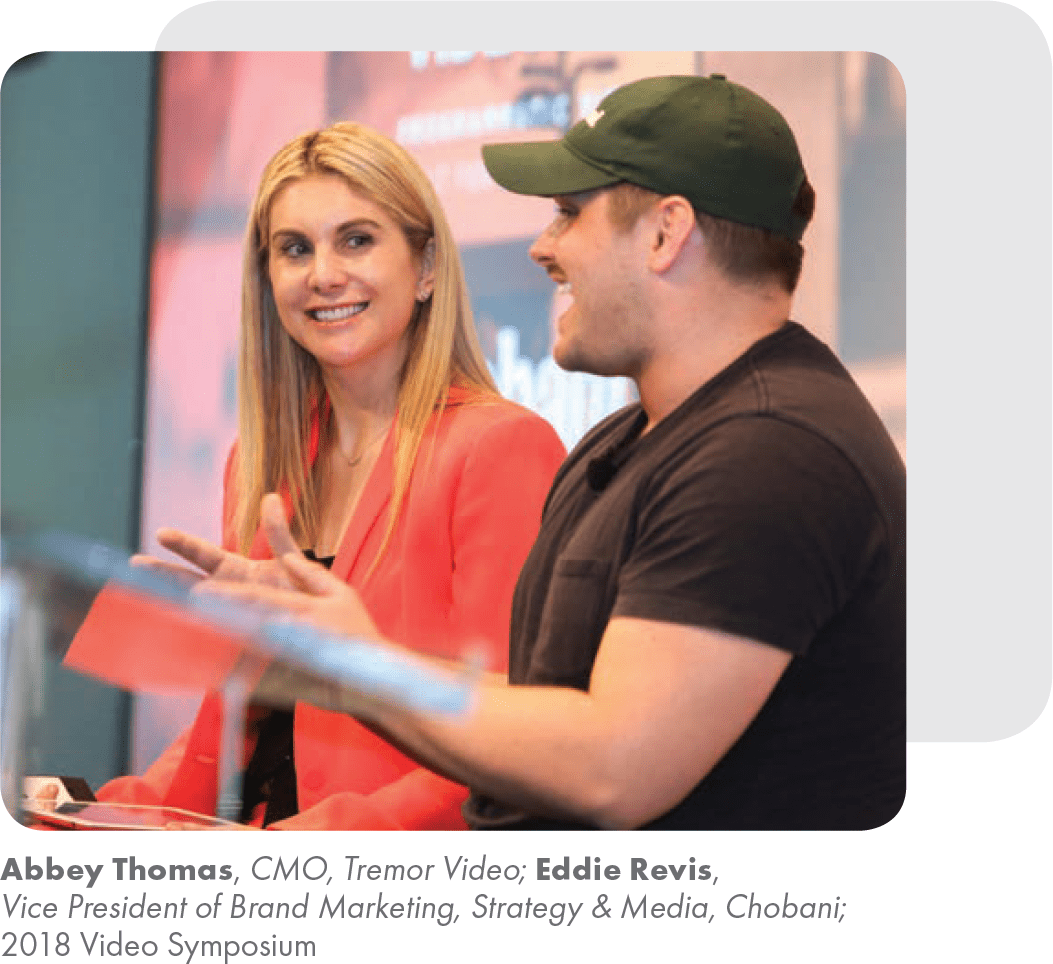

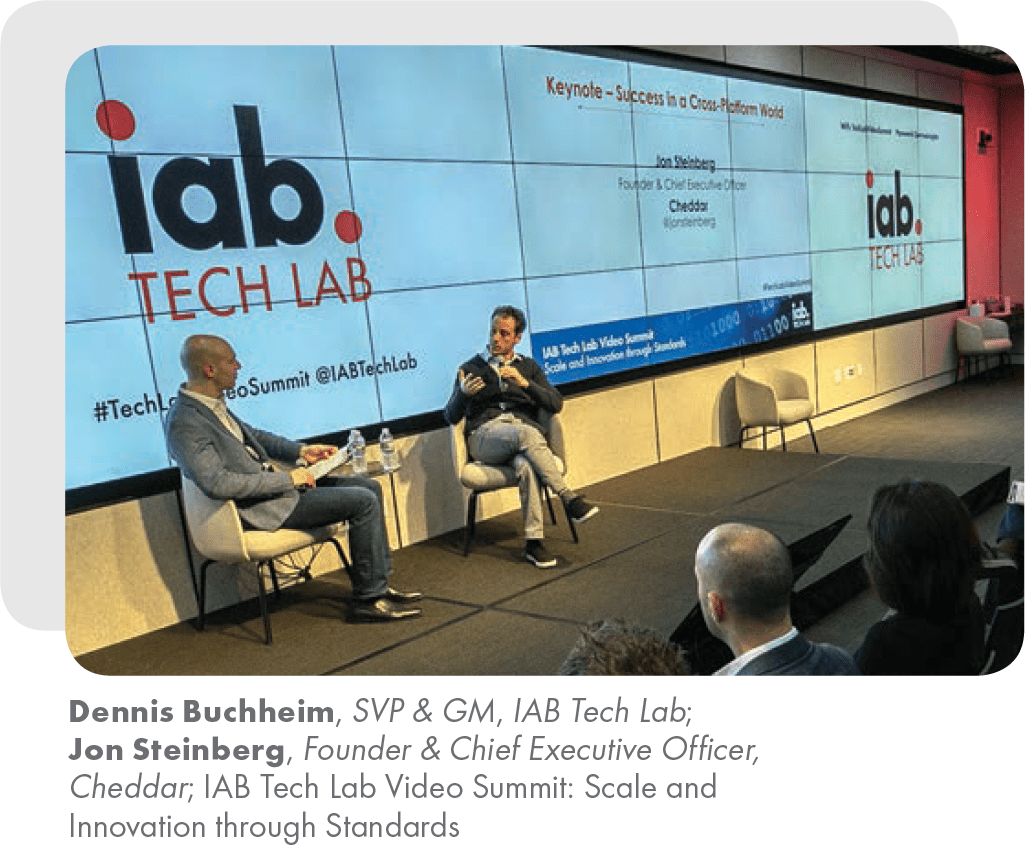

To help our members and the industry discover and participate in best-in-class digital video creative, the 2018 Video Symposium titled “How to Build a 21st Century Brand through Digital Video and OTT” brought together industry leaders, marketers, and publishers to explore innovation and strategies for creating, distributing, measuring, and maximizing the use of video across platforms. Key industry thought leaders shared their first-hand experiences on how to monetize OTT, use data to understand the connected consumer and measure campaign impact, as well as revealing strategies for developing OTT creative.

Marketplaces like the IAB Digital Content NewFronts and IAB NewFronts West also play a powerful role connecting buyers and sellers of digital video content in the largest annual upfront marketplace for digital video and emerging media forms. Confirming the importance of the event as a catalyst for media buying decisions, eight in ten advertisers (81 percent) have said that they increased their original digital video budget as a result of attending the NewFronts.

Introducing brands and media buyers to the latest in original digital video programming, and fostering continued growth of the nascent podcast industry through creative innovation and showcasing advertising opportunities across emerging media is a core tenet of IAB. The sold-out IAB Podcast Upfront 2018 in New York in September was a one-day marketplace designed for advertisers and media buyers to preview the latest in innovative podcast programming from some of the biggest names in the digital audio arena.

To help prioritize and solve industry-wide issues in the video space, each year in July the Video Center hosts the Annual Video Leadership Summit, an invite-only meeting that gathers leading industry stakeholders to address the key problems facing the video industry.

Developing Talent-Rich Organizations

As the digital media and advertising industry grows, IAB members have asked for more training programs to build the talent pool by improving skills in the digital media and advertising industries and expanding certification programs in sales, data solutions, and ad operations. The IAB Certification Program continues to expand in size and global recognition. In 2018, IAB also launched a variety of training programs and events to support our members.

In an effort to provide IAB members with an all-inclusive certification and training option that better caters to their organizational needs, we introduced the All Access Pass to our learning and certification efforts. This offering is for organizations looking to activate large groups of employees with unlimited access to IAB’s online courses and certifications.

The ongoing demand from members for IAB learning and certification programs is a validation of how important training is for the industry as a whole to extend the talent pipeline and our commitment to ensuring members’ needs are being met.

Recognizing the uniquely important role that learning and development (L&D) programs play in successful media and marketing organizations, the IAB Learning & Development Council published the IAB Guide to Learning & Development Best Practices, examining and sharing our community’s expertise to provide advice to senior leaders on implementing an L&D function within their organization, as well as advice to L&D practitioners on improving the quality and impact of their learning programs.

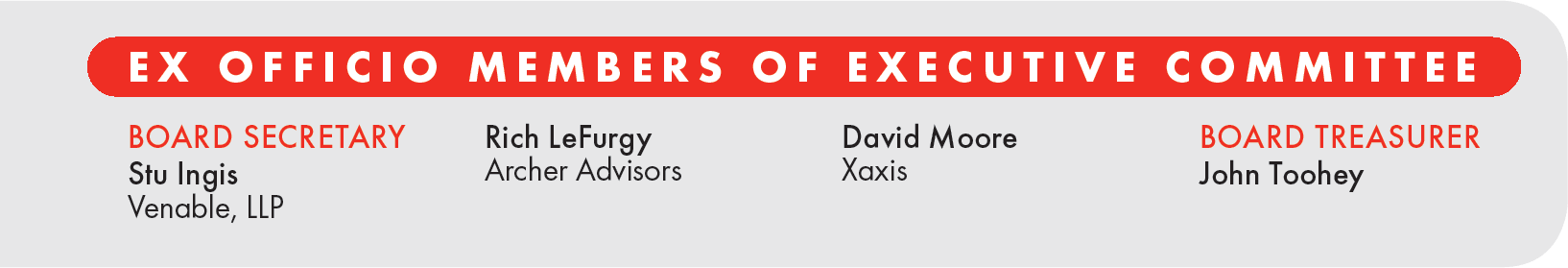

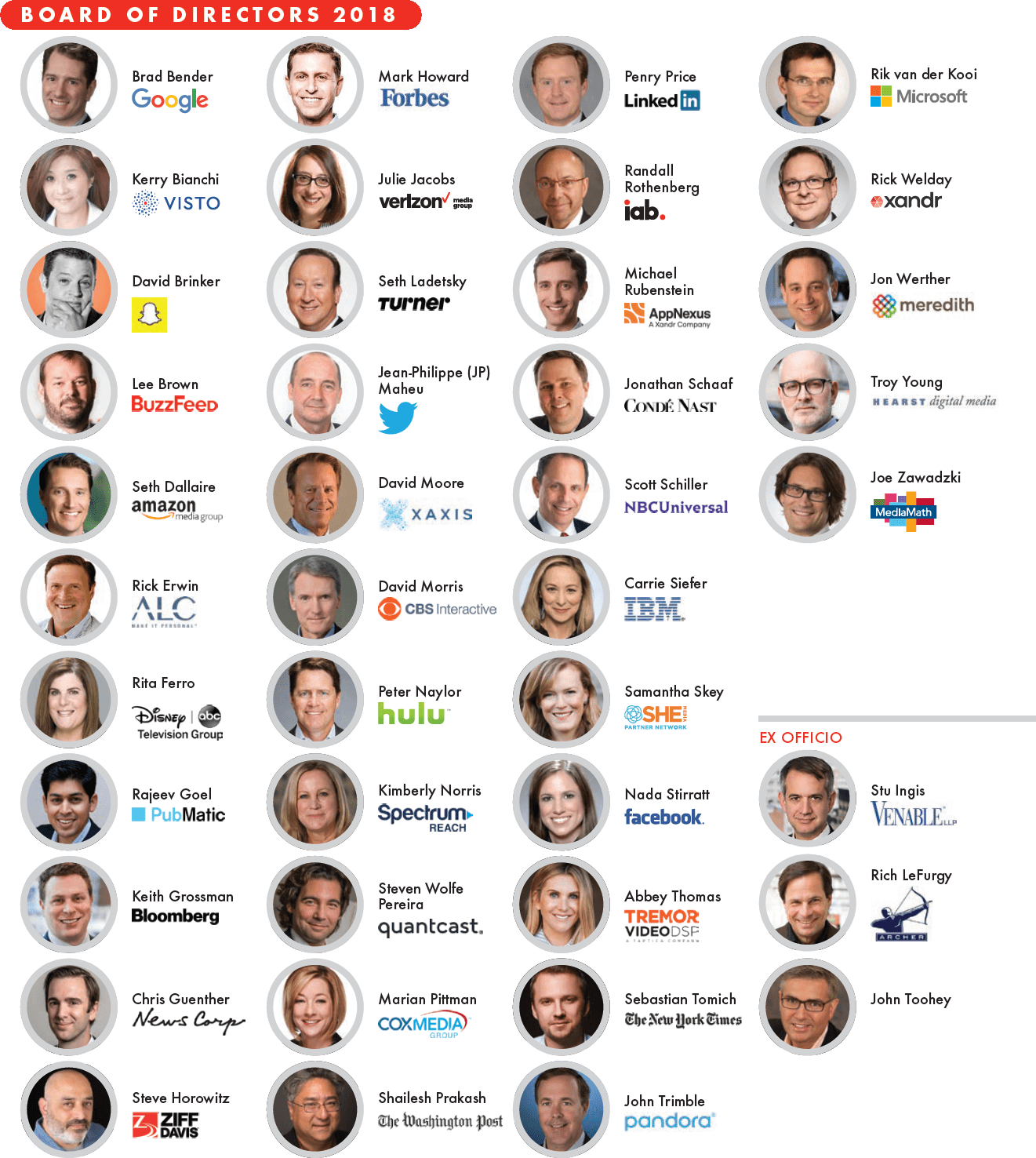

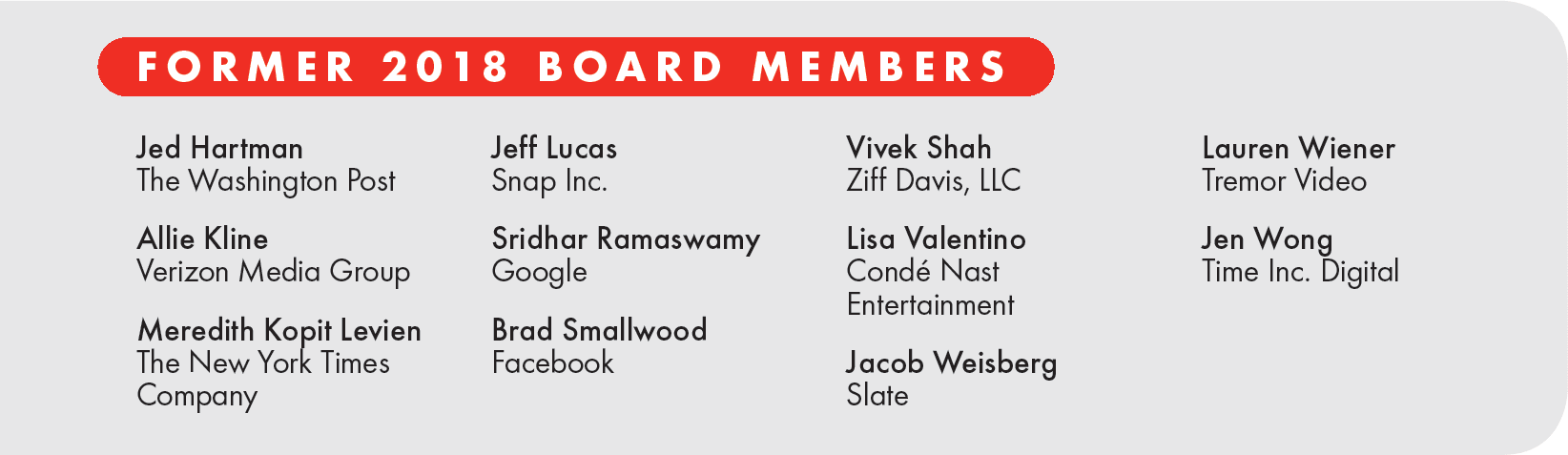

2018 Board

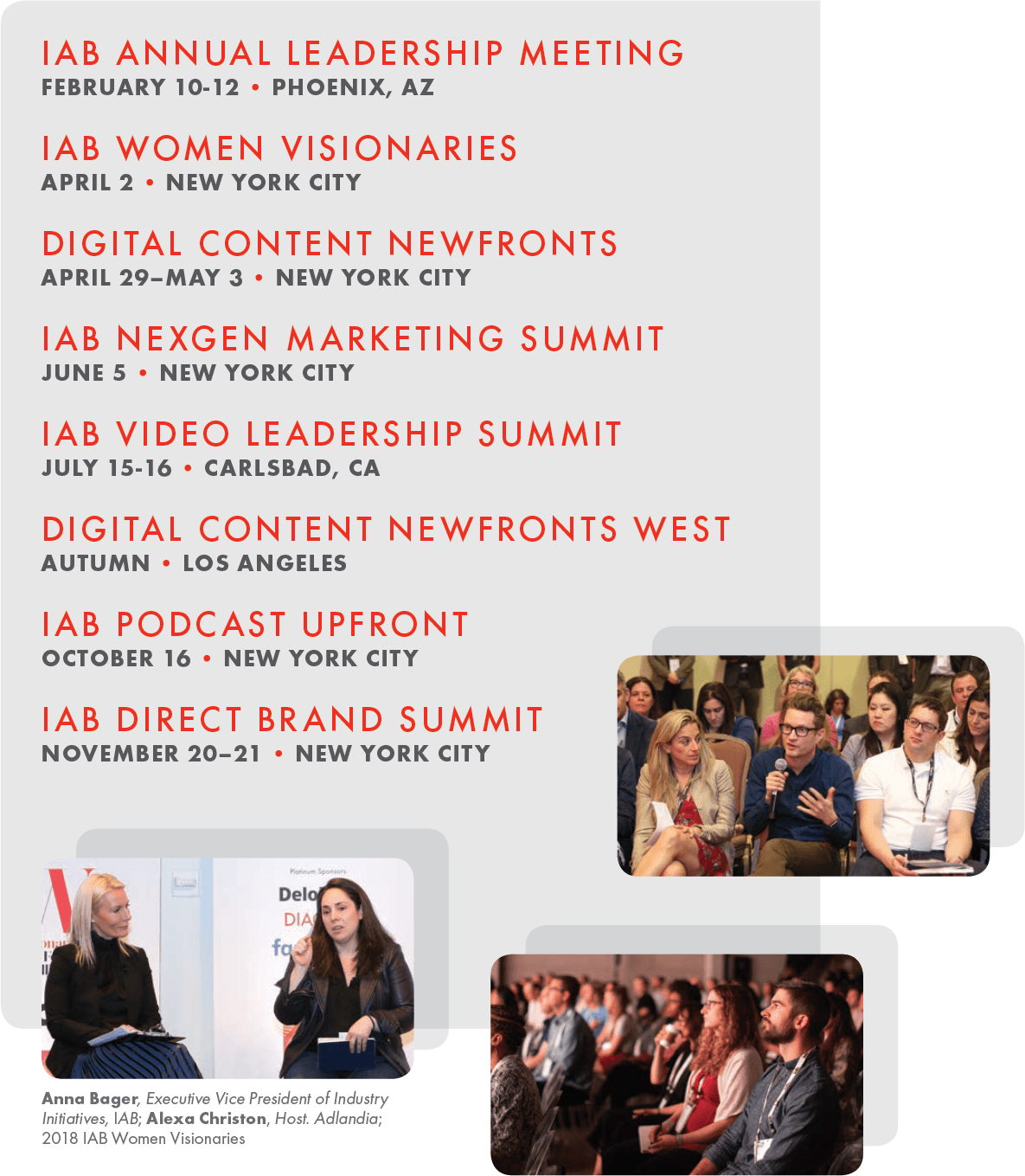

IAB Events: Building Marketplaces

As part of our efforts to refocus the interactive industry toward truly inspiring creative, marketplaces like the IAB Digital Content NewFronts, the IAB Podcast Upfront, the Content Studio Showcase, and the IAB NewFronts West play a powerful role connecting buyers and sellers of digital video and emerging media forms.

As part of our efforts to refocus the interactive industry toward truly inspiring creative, marketplaces like the IAB Digital Content NewFronts, the IAB Podcast Upfront, the Content Studio Showcase, and the IAB NewFronts West play a powerful role connecting buyers and sellers of digital video and emerging media forms.

Leveraging the success of the Digital Content NewFronts in New York, IAB went to the West Coast in the Fall of 2018 to celebrate the LA creative community and to present the first-ever NewFronts West, a two-day marketplace in Los Angeles. With the inaugural theme—“Hello, LA: Where Ideas Meet Content”—the marketplace had a laser focus on content creation and big ideas.

IAB Events: Convening Thought Leaders

IAB is the leading convening force bringing publishers, platforms, brands, and more digital players together to solve industry challenges. As platform and publisher interdependency continues to grow, IAB facilitates high-level conversations between key parties and members throughout the year.

IAB is the leading convening force bringing publishers, platforms, brands, and more digital players together to solve industry challenges. As platform and publisher interdependency continues to grow, IAB facilitates high-level conversations between key parties and members throughout the year.

Public Policy: Leading Public Policy & Advocacy Efforts in A Volatile Regulatory Environment

In the U.S. and around the world, policymakers are pushing legislation and regulations that threaten to kill or cripple the digital media industry. Whether it is testifying on behalf of our members in Congress or working to help our members testify, IAB has been at the forefront of addressing the increased scrutiny policy makers have of our industry. The IAB policy team with the help of IAB members and industry association allies have worked together to minimize the impact of the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and the host of new federal and state level laws that are working their way through drafting committees. IAB continues to be a strong force for policy and advocacy on behalf of our members at the federal, state, and global level in support of consumer privacy, data security, supply chain safety, advertising taxation, and other major regulatory and legislative issues.

Transparency and Disclosure in Digital Political Ads

With the mid-term Congressional elections in November, IAB and the Digital Advertising Alliance (DAA) led the charge toward new and meaningful transparency into online political ads. The “Political Ads” icon was released by DAA in May, and is an outgrowth of its ubiquitous AdChoices symbol. The new icon took center stage at a Federal Election Commission (FEC) hearing in June, at which IAB testified. The Political Ads icon was received warmly by the FEC, and IAB is working with the FEC to promote its familiarity and use to consumers viewing digital political ads.

The Value of the Advertising-Supported Internet

The Federal Trade Commission held a series of workshops running through the winter looking at the issues of competition and consumer protection. In advance of the workshops, IAB filed comments highlighting the belief that self-regulatory models, coupled with well-reasoned sectoral laws focused on concrete consumer harm, have improved consumer protection, privacy, and security over the past twenty-plus years, while also promoting innovation and growth in the modern internet-enabled economy.

Navigating the General Data Protection Regulation (GDPR)

The European Union’s General Data Protection Regulation (GDPR) is now in effect and has profound implications for all publishers, platforms, advertisers, and brands. IAB has been hard at work helping our members navigate this critical and essential change in the advertising landscape and provided feedback on the E.U.-U.S. Privacy Shield Framework at the request of the European Commission.

The European Union’s General Data Protection Regulation (GDPR) is now in effect and has profound implications for all publishers, platforms, advertisers, and brands. IAB has been hard at work helping our members navigate this critical and essential change in the advertising landscape and provided feedback on the E.U.-U.S. Privacy Shield Framework at the request of the European Commission.

The IAB Public Policy Office has also coordinated a global policy strategy with international counterparts to more effectively advocate for the digital advertising industry before foreign governmental agencies.

IAB Global Network: Accelerating Global Growth

IAB supports our members’ international agendas by leveraging the strength and collaboration of the IAB Global Network, encompassing 47 IAB organizations across 6 continents. The international team aims to further the overall mission of IAB and to serve the interactive ad industry globally by advancing global thought leadership, expanding the IAB brand into strategic markets, and encouraging self-regulation and public policy. This year the IAB Global Network focused almost all its efforts on an issue that profoundly affects the entire media and marketing ecosystem: GDPR.

GDPR Transparency & Consent Framework

IAB has been hard at work helping our members navigate this critical and essential change in the advertising landscape. In April, IAB Europe and IAB Tech Lab released the final V1.1 technical specifications for GDPR Transparency & Consent Framework. The Framework is a cross-industry effort to help publishers, technology vendors, and advertisers meet the transparency and user choice requirements (including consent) of GDPR. The Framework is a non-commercial, open source initiative.

IAB GDPR Hub

To help publishers, advertisers, and brands comply with GDPR, these resources from the IAB Global Network are available on the IAB GDPR Hub and are updated regularly. We also convened industry experts for the IAB Tech Lab’s GDPR/ePrivacy Technology Town Hall in New York and San Francisco and an event in Washington D.C. called “Beyond Readiness: The GDPR – What to Expect After May 25”. We hosted a series of webinars to answer urgent and tactical questions for our members about this new regulation.

Shaping Future Legislation

To provide input on the negative impact GDPR is having on U.S. businesses and to share guidance in advance of government-to-government dialogues, IAB has held briefings with the State Department, Commerce Department, and Office of the United States Trade Representative. IAB has also begun a concerted effort of working with the U.S. government to address the echo effect that GDPR is having as countries around the world consider similarly restrictive data laws.

New Global IABs

Recognizing the need for more cross-border collaboration, education, and research across national borders, IAB has expanded in Asia, agreeing to allow IAB Singapore to become IAB SEA + India in October to represent the local markets of Southeast Asia and India. Singapore is the hub for a significant amount of regional business activity, and because IAB Singapore has grown so significantly since its founding a decade ago, this extended remit should benefit all IAB stakeholders. In February 2018, IAB and the Digital Marketing Association of Hong Kong (HKDMA) had also announced that HKDMA was becoming the 47th IAB licensee, named “IAB Hong Kong powered by HKDMA.”

Recognizing the need for more cross-border collaboration, education, and research across national borders, IAB has expanded in Asia, agreeing to allow IAB Singapore to become IAB SEA + India in October to represent the local markets of Southeast Asia and India. Singapore is the hub for a significant amount of regional business activity, and because IAB Singapore has grown so significantly since its founding a decade ago, this extended remit should benefit all IAB stakeholders. In February 2018, IAB and the Digital Marketing Association of Hong Kong (HKDMA) had also announced that HKDMA was becoming the 47th IAB licensee, named “IAB Hong Kong powered by HKDMA.”

IAB Centers of Excellence

IAB Centers of Excellence provide the next phase of leadership required for continued growth of the interactive advertising industry.

Data Center of Excellence

Driving Transparency and Accountability in Data

To drive the data agenda for the digital media, marketing, and advertising industry, IAB launched the IAB Data Center of Excellence in 2016 with the mission to define boundaries, reduce friction, and increase value along the data chain, for consumers, marketers, and the ecosystem that supports them. Key efforts in 2018 focused on helping bring programmatic in-house, defining the data stack, and supporting key research to foster a better understanding of the current state of data in the interactive landscape.

Data Demystified

To help companies and our members become more data-centric, and understand where U.S.-based marketers, publishers, and others invested more than $20 billion in data in 2017, the Data Center of Excellence launched a five-city roadshow titled “Data Demystified”, leveraging the results from the Data Centric Organization and Data Marketing Sizing Research.

Bringing Programmatic In-House

To help define the different types of solutions that can help take charge of programmatic platforms, the Data Center is leading the industry understanding of the in-housing programmatic trend that many marketers and brands are undertaking. As a follow-up to the research, the Data Center hosted a Programmatic Brand Summit with the theme “Bringing It In-House”.

A Marketer’s Guide to Defining the Data Stack

This is an in-depth educational examination into how both rising direct brands and mainstay traditional brands can identify their current place in the data ecosystem.

The State of Data

The State of Data 2018: A Snapshot into the Evolving Role of Audience Insight is a data benchmarking survey that provides a state of the union perspective that practitioners can use to benchmark their current efforts and plan for the year ahead.

Data Rock Stars 2018

The awards recognize outstanding work being done by data industry practitioners, encouraging greater interest in the dynamic field of data science.

DOOH Metrics Glossary

DOOH Metrics Glossary

This interactive guide aims to serve as a reference for planners, buyers, and strategists who are looking to engage with Digital Out-of-Home (DOOH) media.

DOOH + Mobile Attribution Case Study Collection

From driving in-store visits to increasing app downloads and propelling social and online action, these case studies were released in October 2018 to illustrate the myriad of ways marketers across verticals are driving growth through mobile and digital out-of-home.

From driving in-store visits to increasing app downloads and propelling social and online action, these case studies were released in October 2018 to illustrate the myriad of ways marketers across verticals are driving growth through mobile and digital out-of-home.

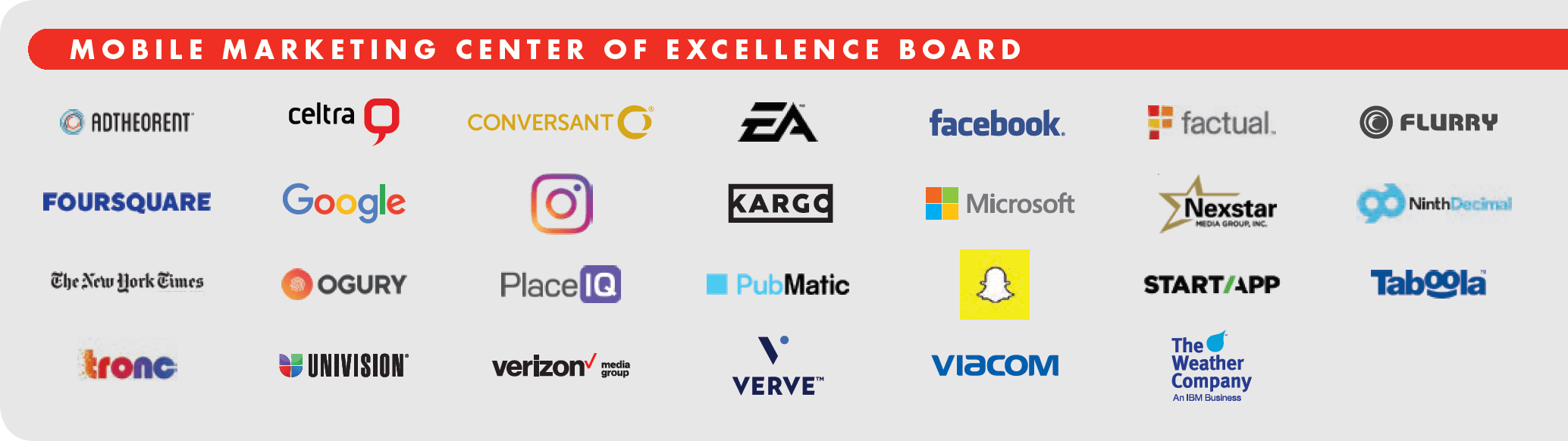

Mobile Marketing Center of Excellence

Best-in-Class Mobile Marketing That Puts Consumers First

The Mobile Marketing Center of Excellence, led by a Board of Directors from leading mobile companies, is charged with empowering the media and marketing industries to thrive in a mobile-always world and in an increasingly direct brand economy, where user experience and consumer relationships are at the heart of modern-day marketing and a significant driver of publisher transformation. Since its launch in 2010, the Mobile Center has helped accelerate the growth of the mobile ecosystem through standard setting, best practices, consumer research, and public advocacy. In 2018, the Mobile Center focused on the following areas:

Mobile Ad Quality Measurement Guide

A big focus for the Mobile Center in 2018 was on ad quality measurement. The Ad Quality Measurement Guide highlights that advertisers should expect their ads to be 1) viewable, 2) displayed next to brand-appropriate content, and 3) seen by real people to understand the many factors that can affect the measurement of ad quality metrics.

Digital Audio’s Role in the Brand Safety Conversation

Meant to increase advertiser confidence in digital audio platforms, this whitepaper offers a summary of why investments in digital audio platforms, both streaming and podcasting, are among the safest digital media investments an advertiser can make today.

Meant to increase advertiser confidence in digital audio platforms, this whitepaper offers a summary of why investments in digital audio platforms, both streaming and podcasting, are among the safest digital media investments an advertiser can make today.

IAB Podcast Upfronts 2018

A marketplace in New York designed for advertisers and media buyers to preview the latest in innovative podcast programming from some of the biggest names in the digital audio arena, the sold-out Podcast UpFronts aimed to educate and raise awareness around the power of podcasts as a valuable platform to reach consumers.

Storytelling in a Direct-to-Consumer Mobile-Always World

To help brands and publishers understand the power of storytelling in the direct brand economy, IAB focused extensively on the subject in 2018 with the publication of three key resources: The Publisher Content Studio Directory featuring nearly 70 IAB member content studios, the Content Creation & Distribution Guide aimed to help the buy-side make sense of today’s options, and the Influencer Marketing for Publishers Guide to help marketers understand why publishers are increasingly adding an influencer component to their branded content offerings.

To help brands and publishers understand the power of storytelling in the direct brand economy, IAB focused extensively on the subject in 2018 with the publication of three key resources: The Publisher Content Studio Directory featuring nearly 70 IAB member content studios, the Content Creation & Distribution Guide aimed to help the buy-side make sense of today’s options, and the Influencer Marketing for Publishers Guide to help marketers understand why publishers are increasingly adding an influencer component to their branded content offerings.

2019 Digital Audio Buyer’s Guide

To help marketers understand the value of both streaming audio and podcasting platforms, the 2019 Digital Audio Buyer’s Guide published in December 2018 contains current research on the medium as well as case studies from IAB Audio Committee members.

Implications of Voice for Marketing Purposes: Market Snapshot Report

This report explores why consumers are adopting voice assistants and smart speakers and what the implications are for marketers and the future of advertising.

Opt-In Value Exchange Playbook for Brands & Case Study Showcase

This first-of-its-kind guide provides guidance on creative delivery, what/how to buy, pricing, and measurement to help brands new to the space get started.

This first-of-its-kind guide provides guidance on creative delivery, what/how to buy, pricing, and measurement to help brands new to the space get started.

Digital Video Center of Excellence

Video Everywhere: Spurring Growth in a Rapidly Evolving Cross-Screen Landscape

Publishers are looking to effectively monetize consumer’s seemingly insatiable appetite for video in a brand-safe environment, especially on mobile. To help our members and the industry discover and participate in best-in-class creative, IAB continues to be a force behind the sold-out and wildly popular IAB Digital Content NewFronts, a video marketplace in New York and now also on the West Coast.

Another important industry event was the IAB Video Symposium which followed the NewFronts and showcased research and other proof points for our members that illustrated what works and why, and best practices to move the industry forward. To help buyers and planners be smarter about investing in digital video, the Video Center also fielded essential new research, tools, and events including:

Digital Content NewFronts: 2018 Video Ad Spend Study

IAB released this study to help our members better understand the video shift in the media landscape and capitalize on it. Among the key findings: 59 percent of marketers’ digital advertising budgets are currently allocated to digital video, a consistent climb in share since 2016.

Building 21st Century Brands: Video Creative Innovation

Showcasing innovation represented a central theme across IAB video initiatives in 2018. The Video Center created a whitepaper that represents the first phase of this innovation initiative and is based on perspectives from thought leaders across publishers, agencies, marketers, and ad tech providers.

Digital Video Viewers and Brand Connection

To better understand digital video’s younger, more ethnically and racially diverse, and tech-savvy demographic, IAB fielded this comprehensive study which highlights how brands have huge opportunities to leverage original digital video (ODV) as an advertising and engagement platform.

IAB Personal Prime Time Study

This study looks at the consumer journey through the lens of seven types of content (episodic shows, music, news, podcasts, short videos, social media, and weather) to identify opportunities for brands to engage with consumers throughout the day during their own personal prime times.

Annual Video Leadership Summit

To address the key problems facing the video industry and to establish the priorities and agenda for the Video Center, in July, the Video Center of Excellence hosted its third Annual Video Leadership Summit, an invitation-only meeting that gathers leading industry stakeholders.

To address the key problems facing the video industry and to establish the priorities and agenda for the Video Center, in July, the Video Center of Excellence hosted its third Annual Video Leadership Summit, an invitation-only meeting that gathers leading industry stakeholders.

Live Video Streaming–A Global Perspective

Expanding video learnings globally, this research study, in partnership with 21 international IABs, sheds light on the growing popularity and ad opportunity of livestreaming video across the globe.

Video Landscape Report

To highlight recent trends, opportunities, and the current state of the video advertising ecosystem for our members, the Video Landscape Report is a compilation of recent studies as well as industry sources of research and analysis, and consultations with dozens of industry practitioners and subject matter experts.

To highlight recent trends, opportunities, and the current state of the video advertising ecosystem for our members, the Video Landscape Report is a compilation of recent studies as well as industry sources of research and analysis, and consultations with dozens of industry practitioners and subject matter experts.

Blockchain for Video Advertising

Blockchain is best known in the context of financial markets and cryptocurrency but new transactional use cases are emerging for blockchain in many industries including media and advertising. IAB developed an in-depth whitepaper called Blockchain for Video Advertising based on interviews with key industry leaders.

Advanced TV Attribution Guide

This guide aims to help educate the buying community on the benefits and opportunities to leverage attribution studies to evaluate campaign ROI.

Marketer’s Guide to Esports: How to Get in the Game

This media buyer’s overview explains how brands can capitalize on this growing market (now numbering over 300 million globally and growing) and evaluate its opportunities.

Digital Video Glossary

The updated version of this glossary was released in December 2018 and added 18 new terms including AVOD (ad supported video on demand) and SVOD (subscription video on demand) and new video formats like skippable video ads, branded video content, and more.

AR & VR Glossary

As new immersive media formats, augmented and virtual reality, while still in the early stages of development, provide unprecedented opportunity for marketers to tell stories that capture user attention and invoke natural exploratory curiosity.

Cross-Platform Training for Buyers and Planners

We want our members to excel in a cross-platform landscape, so IAB introduced a new master class in cross-platform training for buyers and planners at the IAB Ad Lab. The curriculum focused specifically on digital video and advanced TV ecosystems, audience-based planning strategies, programmatic video buying, and more.

Standard Addendum for Digital Video Advertising in TV Long Form Video

To address the technical and business issues specific to advertising in TV long-form video, IAB and the 4A’s released the final version of this addendum ahead of the 2018 Upfront season. This will reduce the delay and expense in preparing multiple, custom agreements and ultimately enhance the efficiency, growth, and competitiveness of the market for advertising in TV long-form video.

Interactive Ad Effect: CTAs in Mobile Video Shoppable Ads

This research focuses on video-based interactive ads in a mobile web environment to understand consumer’s receptivity to interaction, learning about products, and shopping directly within mobile video ads, and what initial calls to action (CTA) work best.

Ad Receptivity and the Ad-Supported Ott Video Viewer

This consumer study developed a profile of who watches ad supported OTT video content and why this audience should matter to marketers.

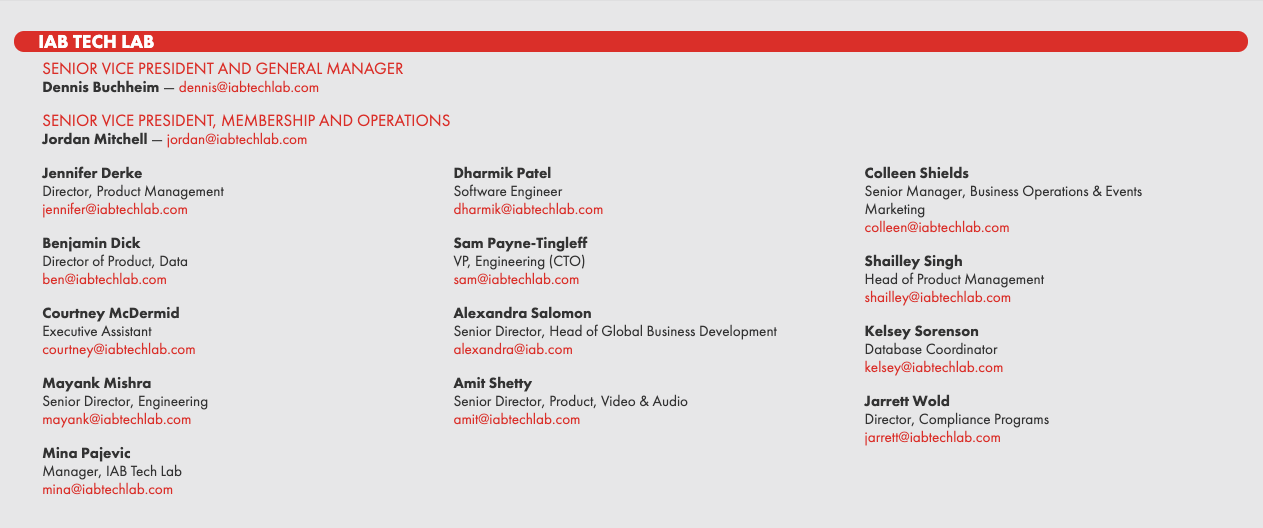

IAB Tech Lab: Standards, Software, and Services to Drive Growth

Rapid growth in our industry has created some unintended consequences such as ad fraud, privacy and security issues, and inefficiencies. To spur industry growth, the IAB Technology Laboratory (IAB Tech Lab), a nonprofit research and development consortium, is charged with producing and helping companies implement global industry technical standards and solutions for the digital media and advertising industries. In 2018 the Tech Lab made real progress towards our collective goals with new standards, protocols, software, and services to drive growth of an effective and sustainable global digital media ecosystem. Those global standards help reduce engineering costs and speed up time to market for our members across the digital supply chain.

Open Data 1.0

A new data nomenclature to facilitate campaign reporting, this is a resource for agency analysts, technology platforms, and data provider companies to aide in merging aggregate reports.

Ads.txt

A valuable and essential tool in fighting fraud and promoting growth, ads.txt (Authorized Digital Sellers) has now grown to over two million domains and publishers continue to adopt it. The beta version of app-ads.txt was also released in November to eliminate fraud on mobile apps and OTT video apps.

OpenRTB 3.0

The IAB Tech Lab has also strengthened efforts to clean up the supply chain, including launching OpenRTB 3.0 with ads.cert beta testing, and deliberations on how to move forward with mobile ads.txt support.

Content Taxonomy 2.0

A resource to enable content creators to more accurately and consistently describe content, facilitating more relevant advertising and providing a higher quality and more granular foundation for data analysis.

Open Measurement Software Development Kit (OM SDK)

To accelerate the growth of mobile and promote third-party viewability and verification measurement for mobile in-app advertising, the IAB Tech Lab released the OM SDK, a set of tools designed to seamlessly facilitate third-party viewability and verification measurement for ads served in mobile app environments.

Demystifying Identifiers and Understanding Their Critical Roles in Advertising

To shed light on identity in a broader context, covering consumers, creative assets, and the businesses involved in the supply chain, the IAB Tech Lab published research devoted to Demystifying Identifiers and Understanding Their Critical Roles in Advertising. The IAB Tech Lab also released Guidelines for Identifier for Advertising on OTT Platforms with recommendations on how to maintain a high-quality advertising experience within over-the-top television (OTT) environments.

To shed light on identity in a broader context, covering consumers, creative assets, and the businesses involved in the supply chain, the IAB Tech Lab published research devoted to Demystifying Identifiers and Understanding Their Critical Roles in Advertising. The IAB Tech Lab also released Guidelines for Identifier for Advertising on OTT Platforms with recommendations on how to maintain a high-quality advertising experience within over-the-top television (OTT) environments.

GDPR Transparency & Consent Framework

A cross-industry effort to help publishers, technology vendors, and advertisers meet the transparency and user choice requirements (including consent) of GDPR, IAB Europe and the IAB Tech Lab released the final V1.1 technical specifications for GDPR Transparency & Consent Framework.

DigiTrust ID Working Group

In support of an effective programmatic supply chain, the IAB Tech Lab has acquired DigiTrust, for a standardized, privacy-compliant consumer ID for the industry’s use. The DigiTrust ID Working Group is aimed at accelerating adoption of the DigiTrust ID broadly, and demonstrating its value as a neutral industry utility that can reduce duplicative cookie syncing efforts, improve match rates throughout the supply chain, and improve bottom line ROI for publishers and platforms.

VAST 4.1 (Video Ad Serving Template)

To provide clear direction on implementing a transparent non-VPAID or Video Player Ad-Serving Interface Verification method, using Open Measurement the IAB Tech Lab released the final version of VAST 4.1.

Blockchain Working Group

Supporting new technologies that can accelerate growth for our members was a priority in 2018 and to that end, the IAB Tech Lab’s Blockchain Working Group launched a pilot program to look at blockchain-based advertising-targeted projects from the working group’s 100+ member organizations.

Podcast Measurement Compliance Program

To accelerate podcast advertising and encourage uniformity in measurement systems and metrics, the IAB Tech Lab Podcast Measurement Compliance Program certifies that companies are adhering to the IAB Podcast Measurement Technical Guidelines, released in December 2017.

Diversity & Inclusion: Promoting a Diverse and Inclusive Ecosystem

A healthy and sustainable digital industry needs talent that reflects the audience it serves. IAB continues to champion the goal of increasing racial, ethnic, gender, and economic diversity in the digital marketing and media industry. IAB is committed to fostering and growing the pipeline of diverse and skilled professionals and to being the convening force in the industry into 2019 and beyond.

A healthy and sustainable digital industry needs talent that reflects the audience it serves. IAB continues to champion the goal of increasing racial, ethnic, gender, and economic diversity in the digital marketing and media industry. IAB is committed to fostering and growing the pipeline of diverse and skilled professionals and to being the convening force in the industry into 2019 and beyond.

IAB also seeks to promote diversity and inclusion in all walks of the interactive marketplace by convening thought provoking events where our members can learn, share, and grow.

Cross-Cultural Marketing Day

The IAB Cross-Cultural Marketing Day emphasized that successful brands must pay attention to their customers’ cultural cues and characteristics to engage consumers with respect.

The IAB Cross-Cultural Marketing Day emphasized that successful brands must pay attention to their customers’ cultural cues and characteristics to engage consumers with respect.

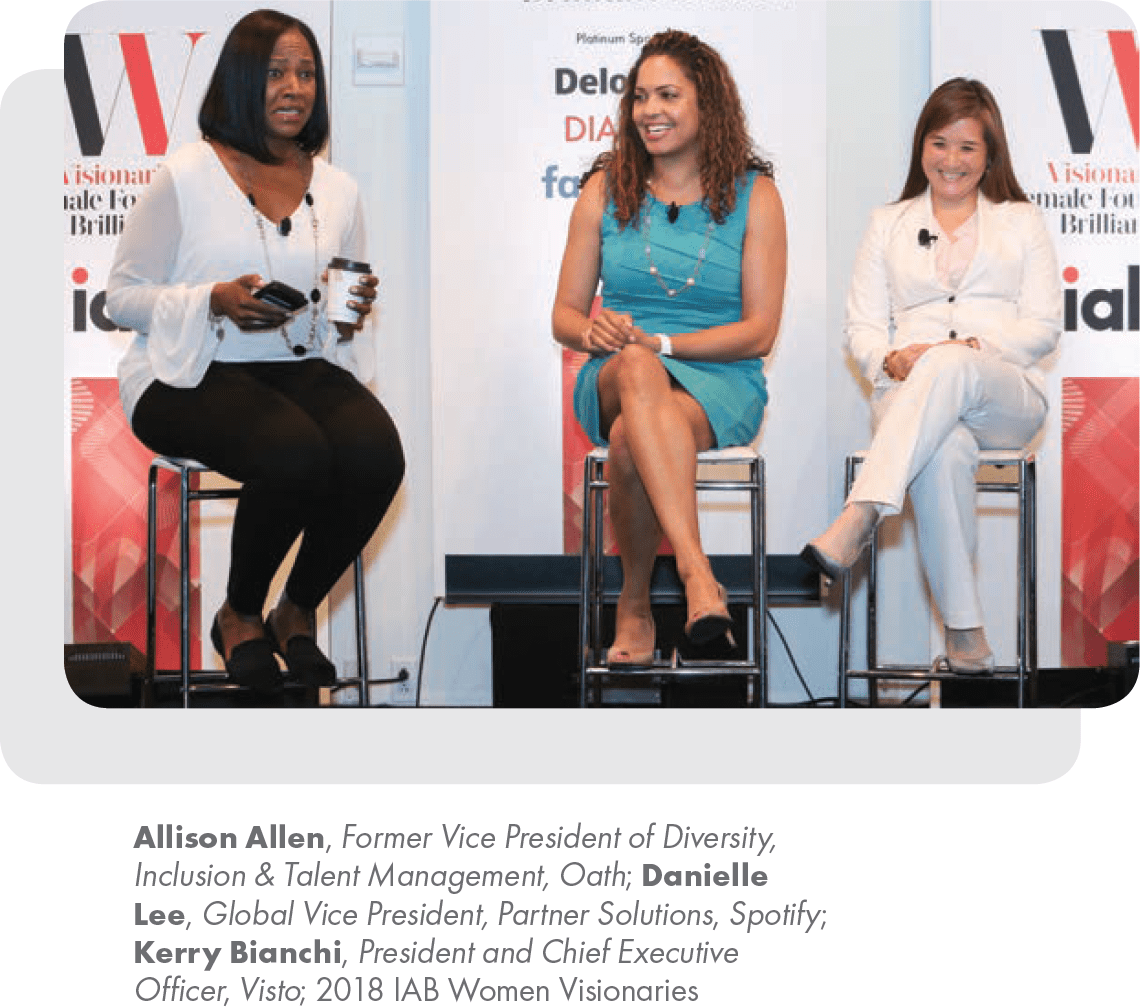

IAB Women Visionaries

In 2018, IAB hosted the first-ever “Women Visionaries: Female Founders and Brilliant Bosses” event in New York City, which sold out. The gathering convened top leaders in tech, media, and marketing to share great lessons in leadership and give real-world takeaways to advance women’s trajectories and the workplace at large.

IAB Members

The IAB mission is to empower the media and marketing industries to continue to thrive in the digital economy, and helping you—our members—is how we strengthen those industries. IAB membership includes more than 650 leading media and technology companies, including 99 that joined in 2018. The Long Tail Alliance—our body representing smaller developers of original digital content, including bloggers and other sites with less than $1 million in annual revenues and fewer than five full-time employees—now includes 1,190 members. Together, they account for 86 percent of online advertising in the United States. We thank all of our members for their support throughout the year.

General Members

33Across

4C Insights

4INFO

A+E Networks

AARP

Acast Stories USA

AccuWeather

AcquireWeb

Activision Blizzard Media

Acxiom

Ad Lightning

Adacado

ADARA

AdBidCentral

AdBrilliant

AdColony

Addapptr

Adform

AdGear

AdKernel

AdLarge Media

adMarketplace

Admiral Adblock Publisher Solutions

Adobe

AdRizer

AdRoll

Adslot

AdSpirit

Adstream

Adswizz

Adtegrity

Adtelligent

AdTheorent

Adversal.com

Adyoulike

Adzerk

Affinity Express

ALC

Alliant

Alphonso Inc

Altice USA

Amazon

AMC Networks

American City Business Journals

American Media, Inc.

American Public Media

Amobee

Ampush Media

AnchorFree

Aniview

Anura Solutions

Anyclip

Anzu Virtual Reality

Appodeal

Arrivalist

Art19

AudienceX

Audioboom

Backbone PLM

BBC Worldwide Americas

Beachfront Media

Bidease

Bidtellect

Bigabid

Blippar

Blis

BlogTalkRadio

Bloomberg

Bounce Exchange

Brightcove

BroadSign

BuzzFeed

C3 Metrics

Cable One Advertising

Cadent

Captivate

CBS Interactive

Cedato Technologies Ltd

Celtra

Centro

Cheddar

Chocolate

Cignal.io

Clear Channel Outdoor

Clipcentric

Collective Bias

Comcast Spotlight

Condé Nast

Connatix Native Exchange

Conversant Media

Cox Enterprises

Crain Communications

Criteo

DailyMail.com

Dailymotion

dataxu

DAX U.S.

DeepIntent

Defy Media

Dianomi

Digital First Media

Digital Remedy

Diray Media

Discovery Communications

DISH

Disney Interactive

DMD Marketing Corp.

Drawbridge

Dstillery

eBay

Electronic Arts

eMarketer

Emodo, Inc.

EMX

Entravision

Equifax

Equinix

Evite Inc.

Expedia Media Solutions

Experian Marketing Services

Extreme Reach

Eyeota

eyeReturn Marketing

Eyeview

Factual

Fandom powered by Wikia

Feature Forward

Flashtalking

Fluent

Forbes Media

Foursquare

FreeWheel

FuelX

Future US

Fyber

Gameloft

GeistM

Genius Monkey

Giant Media

Gimbal

Gimlet

Goodway Group

Groundtruth

Group Nine Media

GumGum

Hanley Wood

Harvard Business Review

HealthiNation

Healthline

Hearst Magazines Digital Media

HIRO-Media

Homes.com

Hulu

IBM Watson Advertising

iHeartMedia

IHS Markit

Index Exchange

Influential

Infogroup

INFORM

InMobi

Innity

Innovid

Instart Logic

Instinctive

Intel

Intersection

Inuvo

Investor’s Business Daily

IPONWEB

IRI

Jivox

Jukin Media

Jun Group

JW Player

Kantar Media

Kargo

Kiip

Kochava

Leaf Group

Legacy.com

Libsyn

Liquidus Marketing

Live Nation

LiveIntent

LiveRamp

Lo70s

Los Angeles Times Media Group

Lotame Solutions

LumenAd

Mansueto Ventures

Market Enginuity

Media.net

MediaAlpha

MediaMath

MediaOcean

MediaShift

Medicx Media Solutions

Merchant Resource Group

Meredith Digital

MeritDirect

MGID

Microsoft Advertising

Midroll Media

MiQ

Mirriad

Mobilewalla

MONSTER

mPlatform

Multiview

Music Audience Exchange

my6sense

NASCAR Digital Media

National Football

League (NFL)

National Public Media

Nativo

NBCUniversal

NCC Media

Netmining

Netsertive

Neustar

New York Public Radio

News Corporation

Nexstar Digital

Nexstar Media

NextVR

NGL Media

NinthDecimal

Nucleus Marketing

Nudge

NYIAX

Oath

Ogury

Ooyala

OpenSlate

OpenX

Optimatic

Oracle’s Data Cloud

Orange142

Outbrain

Outcome Health

Outfront Media

OwnerIQ

PadSquad

Panasonic Avionics

Pandora

Panoply

Parrable

Parsec Media

PCH/Media

Pepperjam

PGA TOUR

Philo

Pixability

Pixalate

PlaceIQ

Platform Inc

PlayBuzz

Pluto TV

PodcastOne

Podtrac

Polymorph

POPSUGAR

Powerinbox

PowerLinks Media

Prisa Digital

Pub Ocean

Public Media Marketing

PubMatic

PubNative GmbH

PulsePoint

PushSpring

Qriously

Quantcast

Rakuten Marketing

RawVoice

Realvu

Refinery29

ReTargeter

Reuters

RevContent

RevJet

rewardStyle

RhythmOne

RockYou Media

Roku

Rooster Teeth / The Roost Podcast Network

Rovio

Rubicon Project

RUN

Sabio Mobile

Salesforce Marketing Cloud

Samsung Electronics America

SAS Institute

Screen6

Semcasting

ShareThis

Sharethrough

SheKnows

Signal

SimpleReach

Simpli.fi

Simulmedia

SITO Mobile

Sizmek

Slate

Smaato

Smart AdServer

SmartyAds

Smithsonian Media Group

Snapchat

Sonobi

SoundCloud

Sourcepoint

Sovrn

Spectrum Reach

Speed Shift Media

Spot.IM

Spotify

SpotX

Springer Nature

SRAX

StackAdapt

StartApp

SteelHouse

Strategy+Business

Stuff Media

Sublime Skinz

SundaySky

SuperAwesome

Swoop

Synacor

Taboola

Tapad

Tapgerine

Tapjoy

TargetSpot

Taunton Interactive

Teads

Tech Mpire

Telaria

The Inquirer

The New York Times Company

The Trade Desk

TheStreet.com

Thinknear by Telenav

Throtle

TiVo

Topix

Torrential

Tremor Video DSP

TreSensa

Tribune Publishing

TripAdvisor

TripleLift

Triton Digital

Trivver, Inc

true[X]

TruEffect

Trusted Media Brands

Tubular Labs

TuneIn

Turner Broadcasting System

UberMedia

Ubimo

Undertone

Unity Technologies

Univision

Unlockd

US News & World Report

USATODAY.com

V12

Valassis

Vertebrae

Vertoz

Verve

VEVO

Viacom

Viant

Vibrant Media

Vice

VideoAmp

Vidillion

ViralGains

Visa Advertising Solutions

Visto

Vivoom, Inc.

VIX

VRTCAL

Vungle

Warner Bros. Digital Media Sales

Washington Post Digital

WBUR

WebMD

Webspectator

Westwood One

WideOrbit

Wiland

Wondery, Inc.

Worldata

WWE

Xandr

XAPPMedia

Xaxis

XUMO

YellowHammer Media Group

Yieldmo

Zefr

Zergnet

Ziff Davis, LLC

Zoom Media

ZUMOBI

Zynga

ZypMedia

Associate Members

Ad-iD

ADLOOX

Advertiser Perceptions

Affinio

AIG

Alliance for Audited Media (AAM)

Anheuser Busch InBev

Anura Solutions

Archer Advisors

Baker & Hostetler LLP

Bionic Advertising Systems

Bonzai

BPA Worldwide

BrightLine

Burt

CDK Digital Marketing

Cisco

Coalition for Innovative Media Measurement (CIMM)

Comscore

Critical Mix

Cuebiq

Deloitte Digital

Dentsu Aegis

DeviceAtlas

DoubleVerify

Dun & Bradstreet

DWA Media

Ebiquity

Ericsson

Ernst & Young

Essence

Evidon

Forensiq

FusionSeven

GeoEdge

Geopath

GfK North America

Gregory Welteroth Advertising

GroupM

Havas Media

HCL technologies

iCrossing

Infinitive

Integral Ad Science

IPG Mediabrands

Ipsos

Johnson & Johnson

Kantar Millward Brown

Magna Global

Marketing Architects

MarketStar

Maru/Matchbox

Media Japan Network

MediaLink

Media Management Inc.

Media Rating Council

Merkle

Mixpanel

Monotype

News Media Alliance

Nielsen

Pebble Post

PIVnet

PMG Worldwide

PMX Agency

PremiumMedia360

Pricewaterhouse-

Coopers

Prohaska Consulting

Pumpt

Redbooks

Research Now SSI

RiskIQ

RPA

Sales Athlete, Inc.

Specialists Marketing Services/d3

SQAD

Standard Media Index

Taco Bell

Television Bureau of Advertising

The Center For Sales Strategy

The Media Trust Company

Theorem

TurboTax

Unilever

Universal Parks & Resorts

Varick Media Management

Veritone One

VidMob

Visual IQ

VSA Partners

White Ops

Winterberry Group

Zentrick

zVelo

Startup Members

Ad Lightning

Admiral Adblock Publisher Solutions

Ad Persistence

Albert

Amino Payments

Apomaya

AppSamurai

BeAlive

Beeswax

Botworx.ai

Cognitiv

FORTVISION

Inspo

Instreamatic, Inc.

Invisibly

KERV Interactive

Konduit

LogoBar Enterprises

LotaData

Lucidity

Madhive

MightyHive

Mixpanel

Mobcrush

NYIAX

Placements.io

Pod Digital Media

Premion

Reveal Mobile, Inc.

Sourcepoint

SpringServe

Teemo

Ternio

Throtle

Traffic Steer

Unacast

Verse

Vertebrae

YourTango

IAB Tech Lab Members

All IAB U.S. general members are automatically members of the IAB Tech Lab. Additional members include:

AdBank, Inc.

AdEx

AdMaster

Apomaya

Axel Springer Group, Inc.

Baidu

BARC India

Bartle Bogle Hegarty

Bitposter

Blockchain4Media

Blue 449

Browsi

CHEQ

Civic

CPEx

Consensys

Cyberagent, Inc.

Cyber Communications Inc.

Dabbl

Deloitte Digital

Didomi

Digital Advertising Consortium Inc.

Display.io

Digitas LBI

FRECKLE IoT

GMO AD Marketing, Inc.

Improve Digital International B.V.

Inside Secure

Insticator

Intowow

JCDecaux

Ligatus

Line

LiquidThread

L’Oreal

Lucidity

Mediasmith

MetaX

Modem Media, Inc.

Momentum

Movable Ink

NEXD

PageFair

Papyrus

Platform161

PIVnet

Pokkt

Publicis Groupe

Publicis Health Media

Publicis Media

Publicis New York

Razorfish Health

Razorfish New York

Regium Operations

Rosetta

RTBAsia

S4M

Shieldsquare

Spark Foundry

Starcom Worldwide (Publicis)

StormX Inc.

Survata

TenMax

Twine Data

Underscore CLT

Videonow

Vivaki

VM1

Weborama

X-Mode

Yeahmobi

Yahoo Japan Corporation

YOSPACE

Zenith Media

ZenithOptimedia Australia

2018 Committees and Councils

IAB helps drive the industry forward through the efforts of committees and councils in various industry segments. These groups include the brightest minds in the industry and work together to develop solutions that improve the interactive advertising and marketing ecosystem for everyone. Committee and council participation is open to any eligible staff at an IAB member company.

Data Center

Jason Fairchild, OpenX, Co-Chair

Jason White, CBS Interactive, Co-Chair

Data Benchmarks & Activation Committee

Valentina Marastoni-Bieser, Cuebiq, Co-Chair

Data Consumer Journey Working Group

Daryl McNutt, Visto, Co-Chair

Margit Kittridge, Critical MIX, Co-Chair

Defining the Data Stack Working Group

Valentina Marastoni-Bieser, Cuebiq, Co-Chair

Ian Rubenstein, GroupM, Co-Chair

Chris Emme, Eyeota, Co-Chair

GDPR Business Best Practices Working Group (Consumer Privacy Working Group)

Digital Out of Home (DOOH) Committee

Adrian D’Souza, Intersection, Co-Chair

Rainbow Kirby, Clear Channel Outdoor, Co-Chair

Alissa Borsa, Meredith Corp, Co-Chair

Greg Williams, MediaMath, Co-Chair

Julie Bernard, Verve, Co-Chair

Measurement and Attribution Committee

Sable Mi, NinthDecimal, Co-Chair

Andrew Covato, Snapchat, Co-Chair

Data Measurement Research Working Group

Measurement Perspective Working Group

Reconciliation of MMM & MTA Working Group

Sable Mi, NinthDecimal, Co-Chair

Peter Minnium, Ipsos, Co-Chair

Multicultural Council

Diego Antista, Google, Co-Chair

Stacy Grahanm, BET Networks, Co-Chair

Mobile Center

Carrie Lieberman, iHeartMedia, Co-Chair

Les Hollander, Spotify, Co-Chair

Gina Garrubbo, National Public Media Co-Chair

Defining an Audible Impression Working Group

Podcast Business Working Group

B2B Committee

Jim Riesenbach, Ziff Davis, Co-Chair

Anudit Vikram, Dun & Bradstreet, Co-Chair

Tusar Barik, LinkedIn, Co-Chair

Games Committee

Agatha Bochenek, Unity Technologies, Co-Chair

Jonathan Stringfield, Activision Blizzard Media, Co-Chair

Local Committee

Kristen Berke, Los Angeles Times Media Group, Co-Chair

Jeanne Brown, Verve, Co-Chair

Brian Czarny, Factual, Co-Chair

Deng Kai Chen, Verizon Media Group, Co-Chair

Matt Kaplan, Univision, Co-Chair

Affiliate Marketing Working Group

Nilla Ali, Buzzfeed, Co-Chair

Julie Van Ullen, Rakuten Marketing, Co-Chair

Augmented Reality (AR) for Marketing Working Group

Joelle Mefford, Meredith Digital, Co-Chair

Tony Parisi, Unity Technologies, Co-Chair

Badi Badkoube, Snap Inc., Co-Chair

Social Media/Native/Content Committee

Judy Lee, Pinterest, Co-Chair

Melissa Diaz, Meredith Digital, Co-Chair

Ari Lewine, TripleLift, Co-Chair

Asher Rapkin, Facebook, Co-Chair

Native Advertising Playbook Working Group

Ari Lewine, TripleLift, Co-Chair

Social/Native Measurement Working Group

User Generated Content (UGC) for Advertising Working Group

David Elkins, TripAdvisor, Co-Chair

Clay Webster, Vivoom, Inc., Co-Chair

Video Center

Doug Fleming, Hulu, Co-Chair

Chris Falkner, Cuebiq, Co-Chair

Adam Lowy, Telaria, Co-Chair

Advanced TV Attribution Working Group

AR/VR Glossary Working Group

Matthew Corbin, Facebook, Co-Chair

Jarred Wilichinsky, CBS Interactive, Co-Chair

Digital Video Glossary Working Group

Esports Working Group

Seth Ladetsky, Turner, Co-Chair

Brian Matthews, NFL, Co-Chair

Mike Sepso, Activision Blizzard, Co-Chair

Terms & Conditions Working Group

Other Committees & Councils

Brand Council

CFO Council

CRO Council

Diversity & Inclusion Task Force

Legal Affairs Committee

Learning & Development Council

Public Policy Council

Todd Thorpe, News Corp, Chair

Research Council

David Ludica, Facebook, Co-Chair

Stephanie Fried, Condé Nast, Co-Chair

Ad Effectiveness Studies Working Group

Cross Platform Measurement Issues Working Group

Improving Ad Revenue Reporting Working Group

IAB Tech Lab

Blockchain Working Group

Data Transparency Standards Working Group

Digital Video Technical Standards Working Group

DigiTrust ID Working Group

Dynamic Content Ad Standards Working Group

GDPR Commit Group

GDPR Mobile Technical Sub-group

GDPR Technical Working Group

Identity Standards Working Group

Mobile Rich Media Ad Interface Definitions (MRAID) Working Group

MRAID Ads SDK Tester Working Group

OpenData Task Force

OpenDirect Working Group

Open Measurement Working Group Commit Group

Open Measurement Working Group Participant Group

OpenRTB Native Working Group

OpenRTB Working Group

OTT (Over-The-Top Video) Technical Working Group

Podcast Technical Working Group

Programmatic Practices Task Force

SafeFrame Implementation Working Group

Taxonomy & Mapping Working Group

The LEAN, DEAL, and Experiences Working Group

TV Convergence Technical Task Force

Video Tools & Best Practices Subgroup

IAB Tech Lab Council

Financial Review: Essential Investments in IAB Member Success and Growth

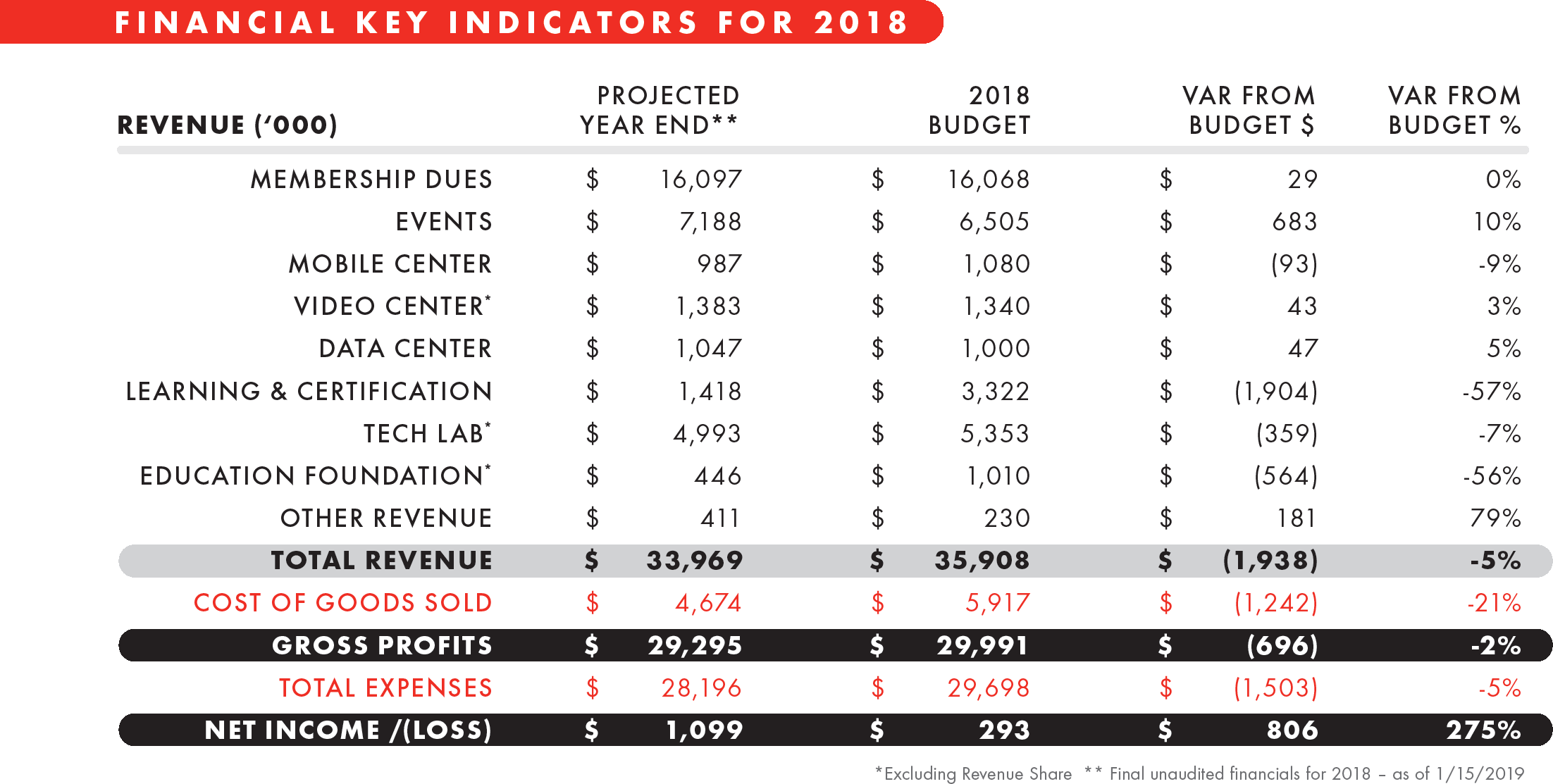

Accelerating the safe and sustained growth of the interactive industry and delivering value to our members are our top priorities at IAB, and the financial state of IAB, like the industry we represent, once again started and ended the year strong.

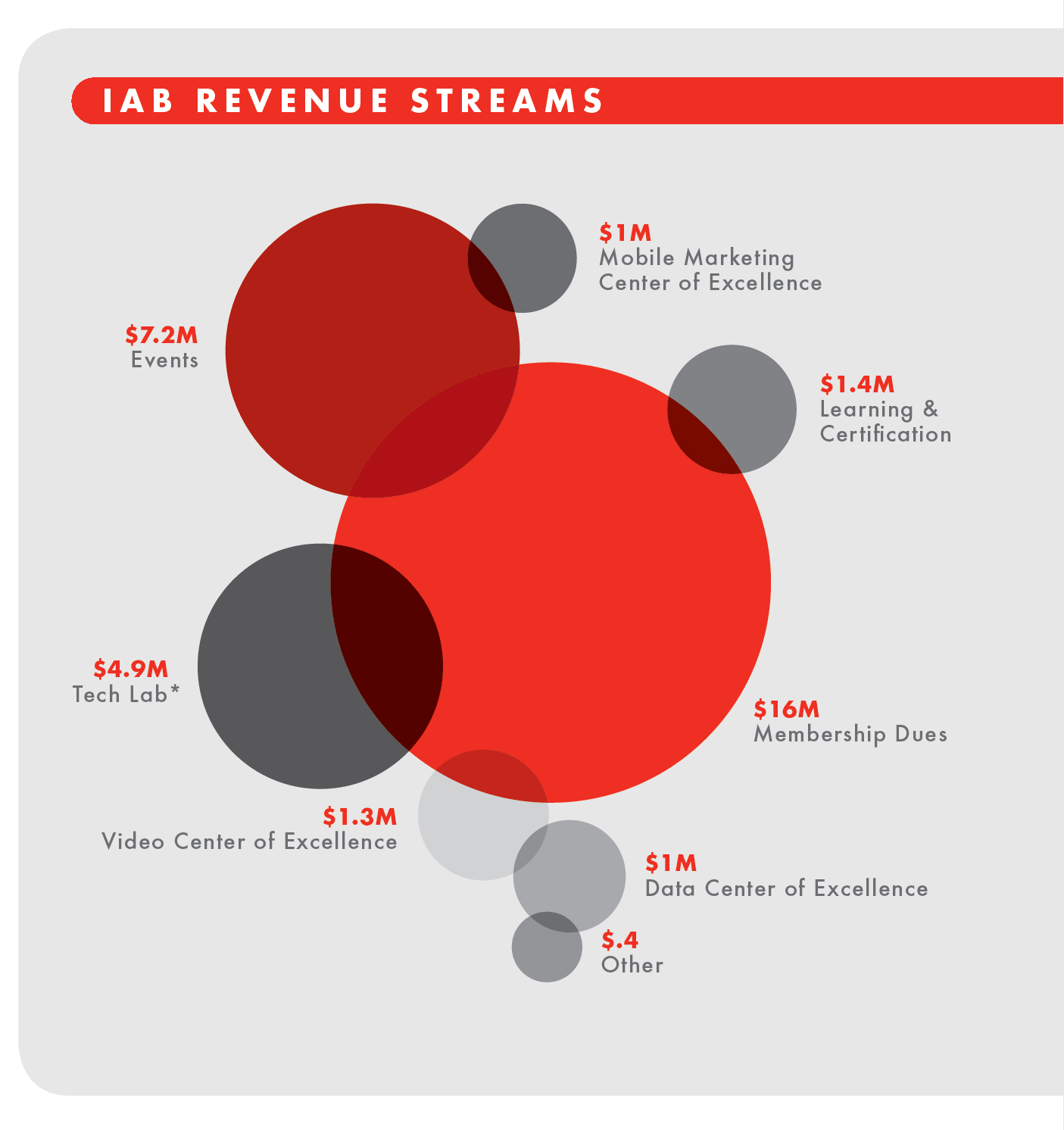

According to unaudited 2018 financial statements, IAB is projected to finish 2018 with topline revenue of $33.9 million, up from $30.9 million in 2017.

Membership dues revenue is projected to be $16 million for 2018, up 2 percent from $15.7 million last year. Events at IAB in 2018 are expected to bring in $7.1 million, 15 percent higher than 2017 and slightly above the projected $6.5 million, thanks to a dynamic and newly created events portfolio including the successful NewFronts West and the Direct Brand Summit.

IAB organizations are also delivering on revenue. The IAB Mobile Marketing Center of Excellence is projected to end the year just below $1 million in revenue, which is a positive sign for the relevance and success of our Mobile Always efforts. The Video Center of Excellence is expected to see revenue of $1.3 million, finishing slightly above budget. The Data Center of Excellence expects a revenue jump to $1 million, a significant 30 percent year-over-year growth thanks to more active board participation.

The IAB Tech Lab brought in $4.9 million in its fourth year of operation (up from $2.6 million in 2017) to develop tools, standards, and best practices that simplify and reduce costs associated with the digital advertising and marketing supply chain. While revenue is expected to be slightly lower than the $5.3 million budgeted, it still saw a significant 90 percent growth thanks to a growing board of directors, new revenue streams like the OM SDK and GDPR Commit Groups, and the first annual Tech Lab industry event.

With Board approval, IAB closed the underutilized San Francisco satellite office. Due to the strength of our tight expense control we were able to accelerate the depreciation and take a one-time $1.4 million non-cash expense. This move will free up over a million dollars in rent and depreciation each year going forward.

With Board approval, IAB closed the underutilized San Francisco satellite office. Due to the strength of our tight expense control we were able to accelerate the depreciation and take a one-time $1.4 million non-cash expense. This move will free up over a million dollars in rent and depreciation each year going forward.

Additional ongoing revenue streams in 2018 included initiatives such as sponsored research, member services, international licensing fees, and other fundraising programs.

In 2018, IAB invested these revenues received towards helping member businesses grow and excel. Funding was directed toward producing valuable third-party research and tools for building brands in digital media.

Overall, IAB managed expenses closely in 2018, which are projected to total $28 million and to close the year with a surplus of slightly more than $1 million.

With our members’ support, IAB is well positioned financially to deliver on an ambitious agenda for championing industry growth in 2019 and beyond.

Who We Are

IAB Offices

Interactive Advertising Bureau

116 East 27th Street, 6th Floor

New York, NY 10016

212 380 4700

Interactive Advertising Bureau

Brawner Building

888 17th St., Nw Suite 312

Washington, DC 20006

Los Angeles

San Francisco

Seattle

IAB empowers the media and marketing industries to thrive in the digital economy. It is comprised of more than 650 leading media and technology companies that are responsible for selling, delivering, and optimizing digital advertising or marketing campaigns. Together, they account for 86 percent of online advertising in the United States. Working with its member companies, IAB develops technical standards and best practices and fields critical research on interactive advertising, while also educating brands, agencies, and the wider business community on the importance of digital marketing. Founded in 1996, IAB is headquartered in New York City.